Reconstructing from an Anti-Fragile Perspective: Research on Business Bottlenecks and Crises of Centralized Exchanges (CEX)

The current cryptocurrency exchange industry shows a significant Matthew effect: the spot trading volume of the leading exchange, Binance, accounts for 29% of the market share, while the other Tier 2 or Tier 3 exchanges usually account for just a single-digit percentage. This polarized landscape reflects the systemic challenges that centralized exchanges may face in 2025. By analyzing the business data of the four top exchanges (Binance, Bybit, OKX, Coinbase), we have found several noteworthy phenomena:

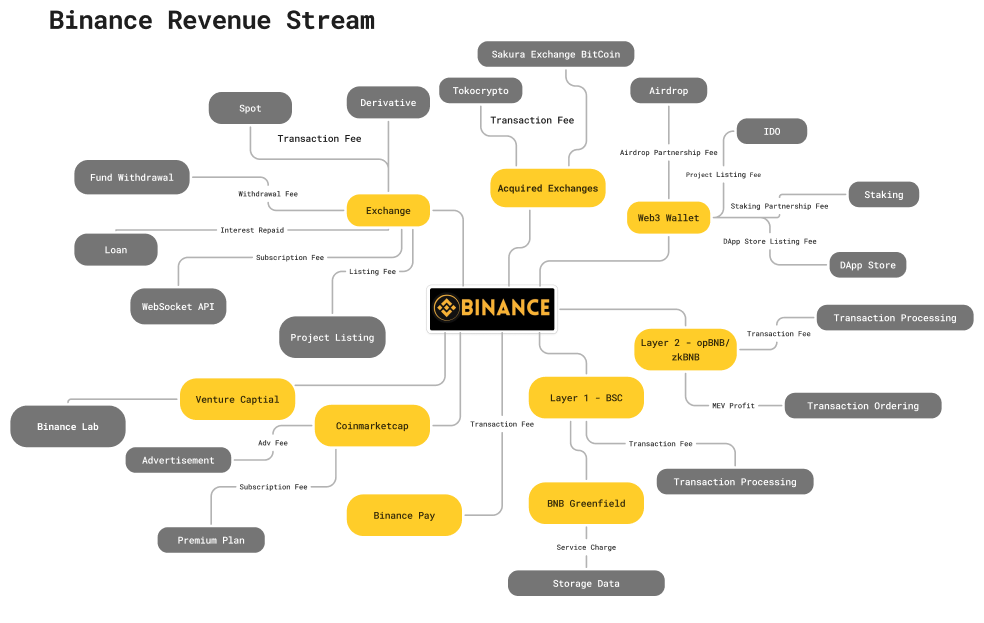

The revenue structure is highly concentrated: As can be seen from the data, the revenues of these exchanges are largely dependent on transaction fees, especially perpetual trading. In the case of Bybit, before the exchange was hacked, its futures trading volume reached $25 billion, which is more than four times the spot trading volume. The singularity of this revenue structure poses significant risks during market fluctuations or regulatory tightening.

The result of Web3 ecosystem construction is different: Although all exchanges are laying out Web3 wallets and on-chain ecosystems, the results are uneven.

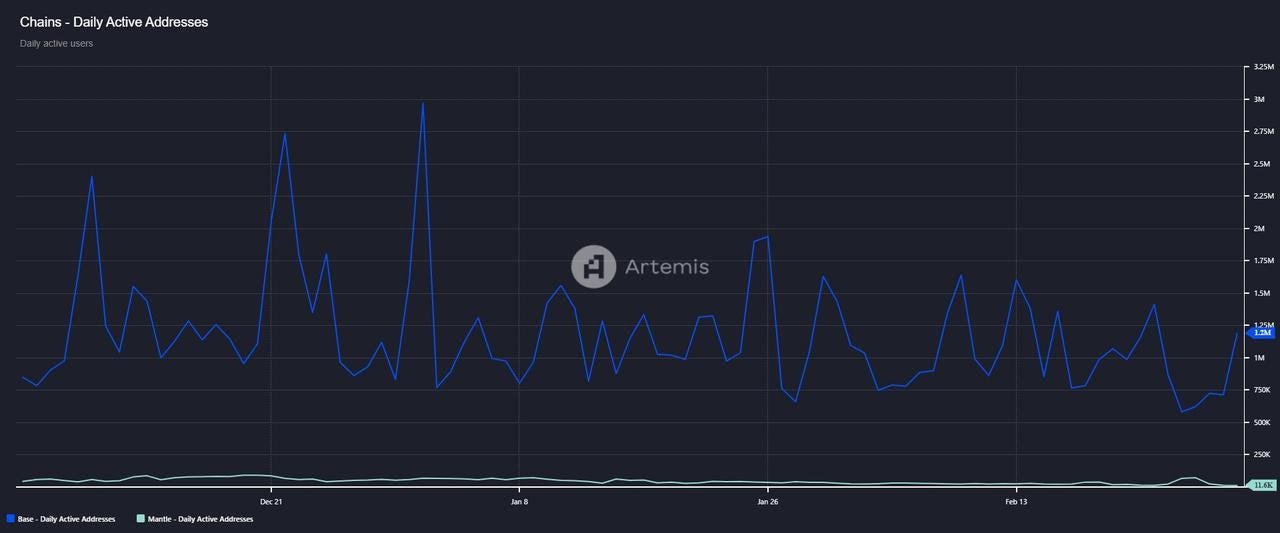

Base chain has up to 1.2 million daily active addresses in this cycle

In contrast, Mantle has only 10 thousand day active addresses

TVL (total value locked) of OKT Chain and X Layer is relatively low

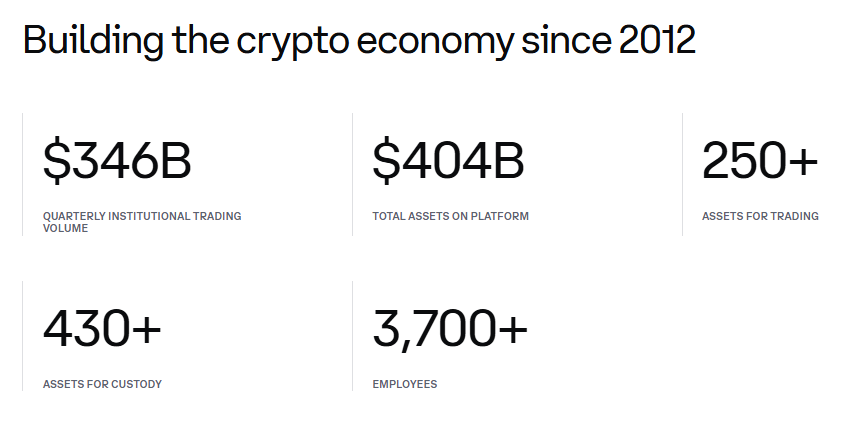

3. Institutional business is differentiated: Coinbase aggressively expands institutional clients through its Prime services, with quarterly institutional trading volume of $346 billion and custodial assets of $404 billion. Meanwhile, the proportion of institutional services provided by other exchanges is relatively low.

This study aims to explore the common bottlenecks faced by the CEX business model:

Sustainability Issues of Excessive Fee Dependence

Input-output efficiency of Layer1/Layer2 ecosystem construction

Contradiction between the Rising User Acquisition Cost and the Decreasing User Stickiness

Bybit: Innovative rate-driven trading platform

Web3 Wallet

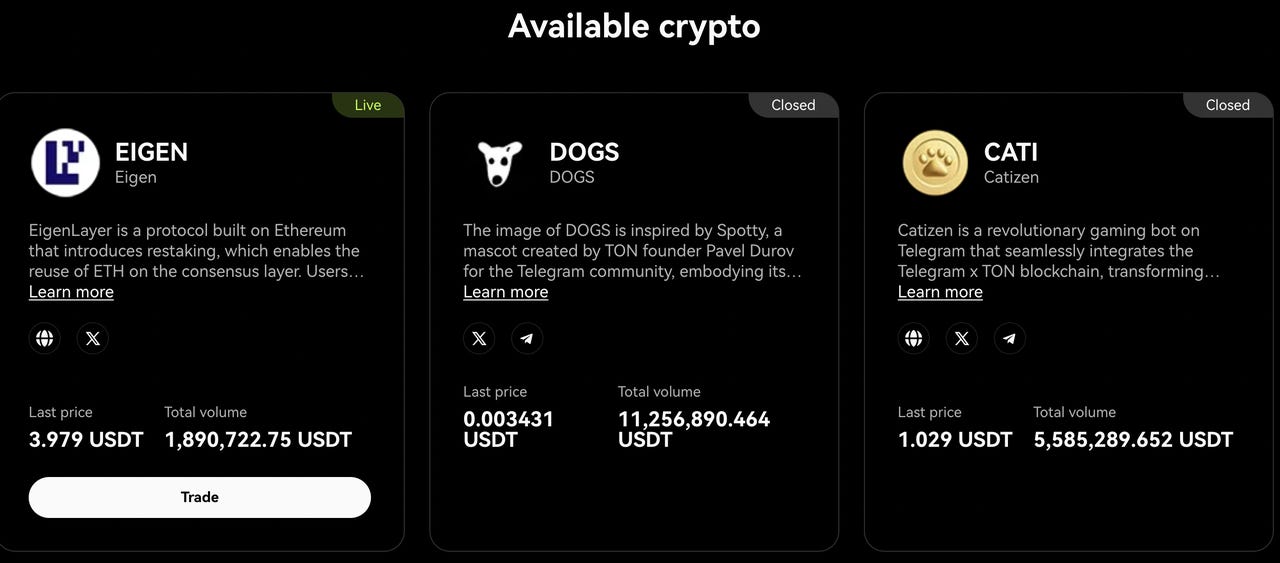

Bybit is building an on-chain ecosystem with the launch of its own Web3 wallet, which supports over 10,000 tokens and more than 20 public chains, and provides services such as airdrops, IDOs, on-chain staking, NFT marketplace, and integration Apex DEX trading.

Airdrop

Through the Bybit Web3 Airdrop Center, users can explore and interact with the latest Web3 dApps and projects, and earn exclusive rewards and airdrops.

IDO

This on-chain token offering initiated by Bybit allows participants to purchase tokens at the offering price, and the return rate can usually be great once the token launches. Bybit’s IDO has raised $3.10 million and launched 37 projects, with an average return of over 2000%.

Bybit has launched IDO 2.0, where participants should complete the points task to obtain the lottery opportunity. The higher the points, the higher the winning rate, and up to a maximum of 60 lottery tickets.

On-chain Staking

Bybit’s on-chain staking feature realizes a one-stop operation, eliminating the need to switch protocols or execute multiple transactions. Simply recharge or collect supported tokens to enjoy a smooth DeFi experience. Currently, staking services cover a wide range, including ETH re-staking, stablecoins, single-currency staking, and dual-currency staking.

Bybit NFT Pro

Bybit NFT Pro is a decentralized NFT market aggregator. Users can browse the list of different NFT markets and list and trade NFT collections at the lowest market fee. It also supports batch listing and trading. The platform is commission-free for NFT buyers and charges only a 1% commission for sellers. Therefore, sellers should pay the following fees each time they sell NFTs.

Bybit’s platform fees

Royalties paid to creators

Apex DEX

ApeX Protocol is a multi-chain decentralized derivatives protocol incubated by Bybit and integrated into Bybit’s Web3 wallet ecosystem. As a non-custodial trading platform, ApeX provides unlimited cross-spread perpetual contracts through its order book mode, making it the only platform among the four major exchanges to provide on-chain order book services.

ApeX currently offers over 70 USDT perpetual and USDC perpetual contracts. Trading data shows a total trading volume of $50.80 billion, with 70.89 million transactions completed and a current open position of 21.15 million. Dex has a maker fee of 0.02% and a taker fee of 0.05%.

Mantle — L2 solution governed and developed by BitDAO

Mantle is an EVM Layer 2 scaling solution designed to improve scalability and reduce transaction costs while maintaining security through Ethereum Layer 1. The relationship between Mantle and Bybit stems from BitDAO’s responsibility for Mantle’s governance and development. BitDAO is powered by Bybit in fund and ecosystem. To fully support and integrate into the Mantle ecosystem, BitDAO’s ecological token $BIT will also be migrated from BIP-21 to the MIP-22 standard $MNT.

As part of BitDAO, Mantle will become the central link for multiple projects, connecting Game7’s gaming program, EduDAO’s research initiatives, and the decentralized application ecosystem supported by BitDAO. Mantle also collaborates with EigenLayer, an Ethereum Middleware, to support key technologies such as optimistic roll-up and ZK-roll-up, using EigenDA as the data availability layer.

To drive the DApp adoption on the Mantle network, BitDAO’s Mantle Core team has proposed a $200 million Web3 fund initiative. It will provide funding to early-stage Web3 startups within three years, to advance the Mantle ecosystem. The fund will be backed by BitDAO’s treasury and external strategic partners, focusing on Pre-seed, Seed, and Series A projects.

However, Mantle’s performance as a Layer 2 is not ideal, and there is a big gap compared to the leading Layer 2 network Base. For example, Mantle has only about 10,000 daily active wallet addresses, compared to Base’s 1.2 million, a difference of more than 120 times.

Exchange

Bybit Exchange had a daily trading volume of over 5.60 billion USD before asset theft, ranking third globally in spot trading volume with a market share of about 13%. Futures trading volume ranked second with a market share of about 28%. However, it is now ranked behind competitors such as OKX and Bitget, and its market share of futures trading volume has also dropped significantly to about 4%.

Spot Trading

Bybit offers over 600 spot token trading pairs, allowing fiat currencies including USD, GBP, EUR, etc. The maker fee and taker fee are both 0.01%.

Market makers include Amber Group, Auros, CyantArb, DWF Labs, Flow Traders, Pulsar Trading, and Raven. Bybit’s Spot Market Market Maker System categorizes market makers into three tiers based on their trading volume and liquidity contribution over the past 30 days, and provides corresponding commission rebates and fee discounts:

MM 1 level: USDT trading volume>$10 million within 30 days, the rebate is -0.001%.

MM 2 level: volume share reaches ≥ 0.1%, the rebate is -0.005%.

MM 3 level: volume share reaches ≥ 0.5% or meets the liquidity requirements, the rebate is also -0.005%, and the buyer’s commission is 0.015%. By increasing the trading volume and liquidity contribution, market makers can earn higher commissions and lower fees, thereby maximizing market profit opportunities.

Pre-market Trading

Pre-market trading is an over-the-counter (OTC) platform designed for trading new tokens before they are officially listed. The platform allows buyers and sellers to set quotes and execute transactions at predetermined prices. When participating in this trading platform, it is necessary to ensure that sufficient funds are prepared in advance and the transaction is completed within the specified time, otherwise, it may result in the forfeiture of collateralized assets.

Derivatives Trading

Futures/Perpetual

Bybit is the second-largest futures trading platform after Binance, Coinbase, OKX, and Bitget, with a daily trading volume of $4.90 billion and 400 futures pairs. Standard maker and taker fees are 0.02% and 0.055% respectively.

Options

Currently, option pairs include BTC, ETH, and SOL with the following fee structure:

Transaction Fee: When opening or closing a position, the maker and taker fees are both 0.02%. The transaction fee for each contract does not exceed 12.5% of the option price.

Settlement fee: When an option is exercised, a settlement fee of 0.015% is charged. There is no settlement fee for unexecuted options or daily options, and the settlement fee for each contract does not exceed 12.5% of the option value.

Liquidation fee: There is a 0.2% liquidation fee when a position is forced to be liquidated, based on the option trading volume and index price.

Copy Trading

Bybit allows traders to copy the trades of other professional investors in the market. The target audience for copying trades is divided into followers and master traders. Followers will copy the trading strategies of the master trader they have chosen. Master traders can promote their strategies, attract followers, and receive a certain percentage of the net profit earned by each follower on Bybit, depending on the level of the master trader.

Trading Robot

Bybit provides various automated trading robot systems. Users only need to set basic parameters, and the platform will assist in investment according to the corresponding program trading strategy. For example, grid trading robots, DCA robots, etc.

Bybit Earn

A full-stack investment management platform covering multiple income products.

Bybit Savings: Earn almost risk-free returns through flexible or regular savings, suitable for investors seeking stable returns.

Liquidity Mining: Earn returns by contributing to liquidity pools, and leverage to expand returns, suitable for investors interested in long-term income and DeFi.

Dual Asset: A short-term trading tool to increase returns through the “buy at the low and sell at the high” strategy, suitable for users who are willing to hold USDT or crypto assets.

ETH2.0 Liquid Staking: Participate in Ethereum network validation by staking ETH to earn while maintaining the liquidity of assets, suitable for investors who want to keep flexibility.

Double-Win: Non-principal protected short-term structured products, suitable for investors who expect high market volatility.

Discount Buy: Purchase assets at a discount in low volatility markets, suitable for experienced investors and HODLers.

Wealth Management: Grow crypto assets through professional investment strategies, suitable for investors seeking returns and risk diversification across various market conditions.

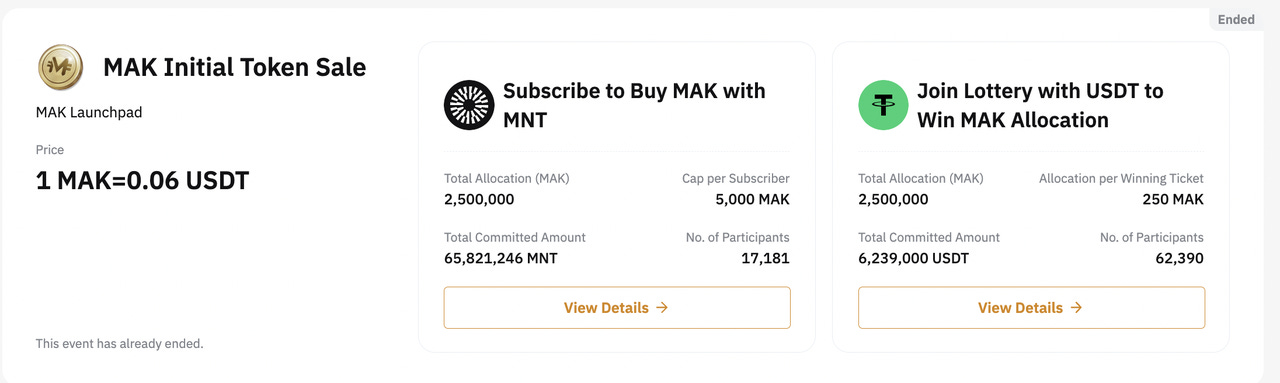

Launchpad + Launchpool

1. Bybit Launchpad

Bybit Launchpad is a platform designed for users who participate in new token launches. Users can use their crypto asset(typically USDT or MNT) to subscribe to new tokens by the launchpad. The projects are usually newly launched ones and subscribe to token allocations by locking in their assets.

2. Bybit Launchpool

Bybit Launchpool is a product that allows users to earn new tokens by staking crypto assets. Users can stake their tokens (not limited to USDT or MNT, but can be a specific token) into Launchpool, and the staked tokens can be redeemed at any time. Users can receive new tokens or corresponding profits based on the amount staked.

Bybit Launchpad is a platform for participating in new token launches, where users subscribe to new tokens by locking in their assets, suitable for early investors.

Bybit Launchpool is a flexible way to earn new tokens by staking crypto assets, suitable for users who want to earn through staking.

Bystarter

ByStarter is a token distribution platform where early users can invest in projects that have not yet been listed on any centralized exchange, although the token listing is not guaranteed. ByStarter usually targets highly vetted and early-stage projects that have not yet been listed on any exchange, and it also accepts projects that have already had an Initial Exchange Offering (IEO) for fundraising. There are currently 5 projects that have successfully raised funds through the platform, with a cumulative fundraising of over 70 million and an average return of over 300%.

TokenSplash

Token Splash is a campaign for all users showcasing the listing opportunities of multiple new tokens. Users can earn rewards in three ways: depositing or purchasing the minimum required amount of relevant tokens during the campaign, or meeting the corresponding volume requirements in spot trading. This provides users who are optimistic about the future potential of new tokens with the opportunity to earn additional rewards by participating in trades and deposits. A total of 171 projects are currently supported with an average return of about $20.

Airdrop

Unlike airdrops via Web3 wallets (which require connection to relevant dApps for interaction), exchanges also allocate a certain amount of airdrop tokens. Users need to complete various tasks to earn points, such as following social platforms, reaching specified deposits or transaction amounts, completing quizzes, etc., to receive airdrop tokens.

Borrowing

Bybit provides borrowing services for individual institutional users. Users can use cryptocurrencies such as Bitcoin and Ethereum as collateral to borrow other digital assets for trading or investment, maintaining ownership of the original crypto assets. The service provides flexible collateral options and borrowing amounts, and users can choose different loan terms according to their needs without credit checks.

OTC Trading

OTC trading allows traders to directly execute orders between two parties at an agreed price outside of the Bybit platform. Bybit’s role is to act as an intermediary in matching transactions up to a maximum of $10 million, and Bybit does not charge any intermediary fees. Currently, OTC trading supports the following pairs: USDT to ETH or BTC, USDC to ETH or BTC. In addition, you can also exchange ETH or BTC for USDT or USDC, or just exchange between USDT and USDC.

Bybit Card

Bybit Card is a Mastercard credit card that supports over 90 million merchants worldwide. Users can choose from various crypto assets as payment methods and enjoy EMV 3-D Secure fund protection, a loyalty rewards program, and 24/7 multi-language customer support. Currently, it supports 1 fiat currency and 8 cryptocurrencies. Fiat currency is determined based on the user’s identity verification country. For example, a German user’s card will be denominated in Euros. If the euro balance in the account is insufficient, the system will prioritize cryptocurrencies as payment. Currently supported cryptocurrencies include BTC, ETH, XRP, USDT, USDC, and TON. Supported regions include Argentina, Brazil, the European Economic Area (EEA), Switzerland, and Australia.

Bybit Card fees vary by region. For the EEA and Switzerland, the foreign exchange fee is 0.5%, while in Australia it is 1%, and in Argentina, it is as high as 7%. Cryptocurrency conversion fee is 0.9% in the EEA and Switzerland, and 0.5% in Argentina, with a minimum conversion amount required. FX price floating surcharge is 3% in the EEA and Switzerland, and 5% in Argentina. Card issuance and replacement fees are free for virtual cards, while physical cards are 5 EUR/GBP/USDT in Europe and 5 USD/USDT in Australia and Argentina. ATM withdrawal fees are waived for the first 100 EUR/GBP or 100 USD per month, and a 2% handling fee is charged for excess. Annual fees account idle fees, and card cancellation fees are all zero.

Mirana Capital

An early-stage cryptocurrency fund that invests in crypto companies strategically related to Bybit and BitDAO with longer-term investment horizons and sizes ranging from $200,000 to $20 million.

Davion Labs

It is an incubator founded by Bybit. Its main work includes three aspects: producing research content; connecting developers and creators; and providing development, financing, and incubation support for promising projects.

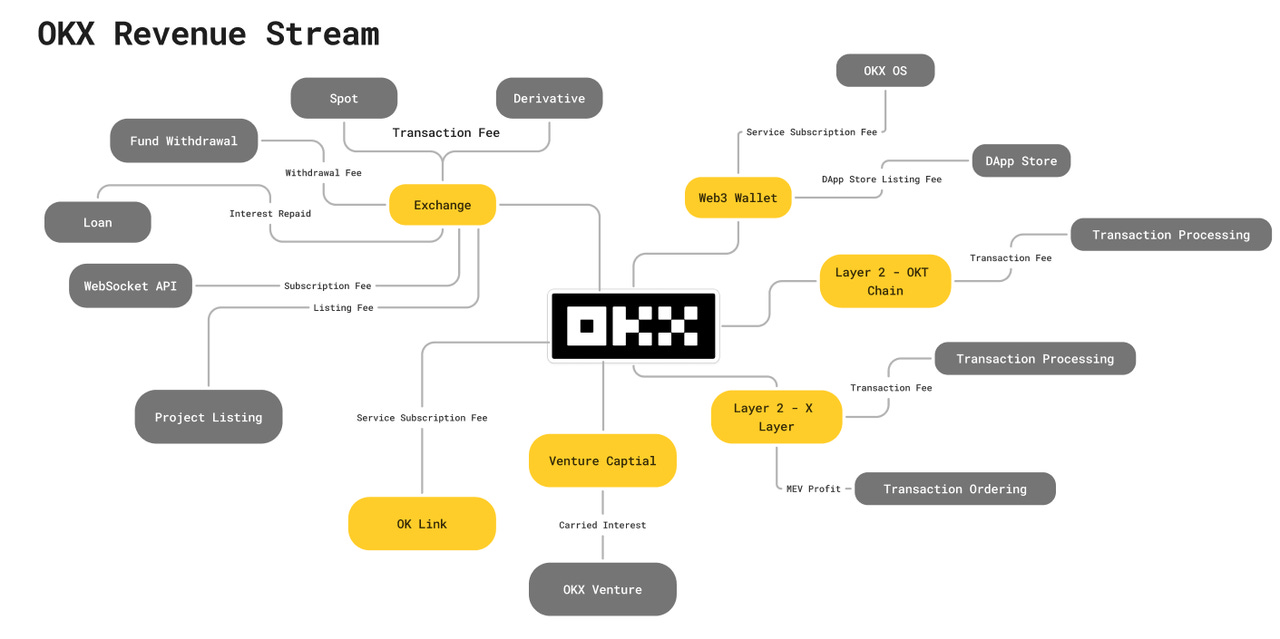

OKX: User Experience First Full Chain Integrator

Web3 Wallet

OKX’s on-chain wallet is the first of its kind among major institutions and also the smoothest to use. Web3 security company CertiK ranked OKX Wallet as the №1 crypto wallet in cyber security among the 43 most popular wallets. According to the data from the Chrome Extension Store, it has been downloaded by more than 1 million users worldwide.

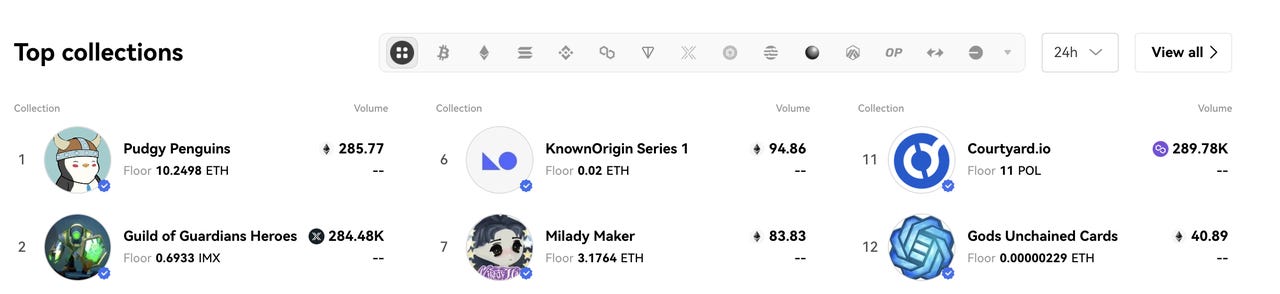

NFT/Inscription and runes market

OKX’s NFT, Inscription, and runes markets are leading the industry, even surpassing Blur at one point with a rich variety and peak daily volume of more than $50 million. Its NFT marketplace offers a 0% listing fee discount, which has become the main advantage in attracting users. With integration of more than 20 public chains such as Ethereum, zkSync, Polygon, and Solana, and more than 30 NFT platforms such as Tensor, OpenSea, and Magic Eden, OKX provides users with optimal quotes and liquidity to simplify cross-chain trading operations.

The market also improves user experience through intelligent interaction strategies and multiple security guarantees, supporting multi-platform orders, one-click signatures, smart contract calling, and gas fee reduction. The optimization of various user experiences also enables OKX to stand out in the NFT marketplace.

OKX also adopts a zero-fee strategy in the inscription and rune market to lower the entry threshold and become the first platform to integrate SRC-20, ARC-20, DRC-20, and Rune Alpha. With extensive product coverage and a first-mover advantage, OKX quickly occupied this ecological market. Users can perform one-stop operations from batch inscription casting to trading in the OKX Marketplace.

On-chain DeFi

OKX’s on-chain DeFi is also integrated into more than 30 public chains and nearly 200 platforms. The platform does not charge additional procedures. DeFi projects include ETH re-staking, stablecoins, single-currency staking, dual-currency staking, and the latest Bitcoin staking, etc.

Swap

OKX’s on-chain DEX only adopts the AMM Pool, unlike Bybit integrating ApeX for Orderbook transactions. It supports 200+ tokens, 20+ public chains, and cross-chain interactions. Swap also provides MEV protection to protect the interests of users.

OKX OS

OKX OS is a Web3 development solution that significantly reduces development time and cost by integrating standardized public chains and protocols. It covers four main scenarios: wallet, DEX, marketplace, and DeFi. OKX OS also provides data query capabilities, in-depth analysis of asset data, transaction history, project information, etc., supporting more than 60 networks including EVM, UTXO, Solana, TON, TRON, and cutting-edge inscription ecosystems. Currently, more than 10,000 developers have participated in the building, and the number of API calls has exceeded 200 million.

OKX Link

OKLink Explorer APIs

OKLink Explorer APIs is a scalable and easy-to-use API solution for Web3 developers, supporting blockchain data from more than 40 mainstream Layer 1 and Layer 2 networks, as well as token data from more than 200 blockchain networks, covering more than 7 million different tokens and NFTs. The API provides comprehensive on-chain data, including basic blockchain data, UTXO data, EVM and Cosmos exclusive data, DeFi and NFT data, token prices, proof of reserve data, stablecoin issuance and destruction records, etc.

OKLink Onchain AML

OKLink Onchain AML APIs are a suite of blockchain and crypto compliance tools that help law enforcement monitor transactions and ensure compliance with AML and Countering the Financing of Terrorism (CFT) regulatory requirements. The core advantage is the use of the industry’s largest and most authoritative address labeling database, which covers hundreds of categories and associates tens of thousands of entities. Through internal security and forensics experts, 24/7 OSINT research and scanning, advanced AI engines, and an extensive network of customers and partners, the high standard quality of the database is ensured.

Chaintelligence

Chaintelligence has tagged 5.20 billion addresses, supports 256 blockchains and 7.40 million crypto assets, and has analyzed more than 1160 cases so far. The platform also provides forensic reports, crypto training and on-site support services to provide strong technical support for case investigation and evidence preservation.

Eaas

EaaS (Explorer as a Service) is a blockchain exploration service provided by OKLink, supporting multi-chain assets, transactions, address data queries, and providing a full-featured browser, powerful search engine, smart contract verification, and reliable API services. By connecting wallets, DEX, and NFT markets in one stop, EaaS helps users easily manage blockchain applications, realize a comprehensive ecological experience, and greatly simplify the development and integration process.

Layer1 — OKT Chain

OKT Chain is designed for dApps and Web3 ecosystems, based on EVM architecture, compatible with smart contracts, and supports cross-chain functions. As of now, OKT Chain transaction volume has exceeded 220 million, the staking volume has exceeded 4 million OKT, the number of active addresses has exceeded 100 million, the market cap has exceeded $160 million, and the on-chain TVL has exceeded 500 trillion.

Layer2- X Layer

X Layer is a Layer 2 network based on ZK technology, connecting the OKX and Ethereum communities. It not only simplifies interoperability between multiple blockchain networks and supports cross-chain transfer of assets and information, but also provides development tools to help developers build dApps in a multi-chain environment.

Exchange

OKX exchange has a daily trading volume of about $7.70 billion, and the spot trading volume ranks fourth globally with a market share of about 7%. The futures trading volume ranks 10th with a market share of about 5%.

Spot trading

It provides over 300 spot token trading pairs and supports over 40 fiat currencies, mainly in South America, the Middle East, and Southeast Asia. The maker fee and taker fee are 0.08% and 0.1%, respectively.

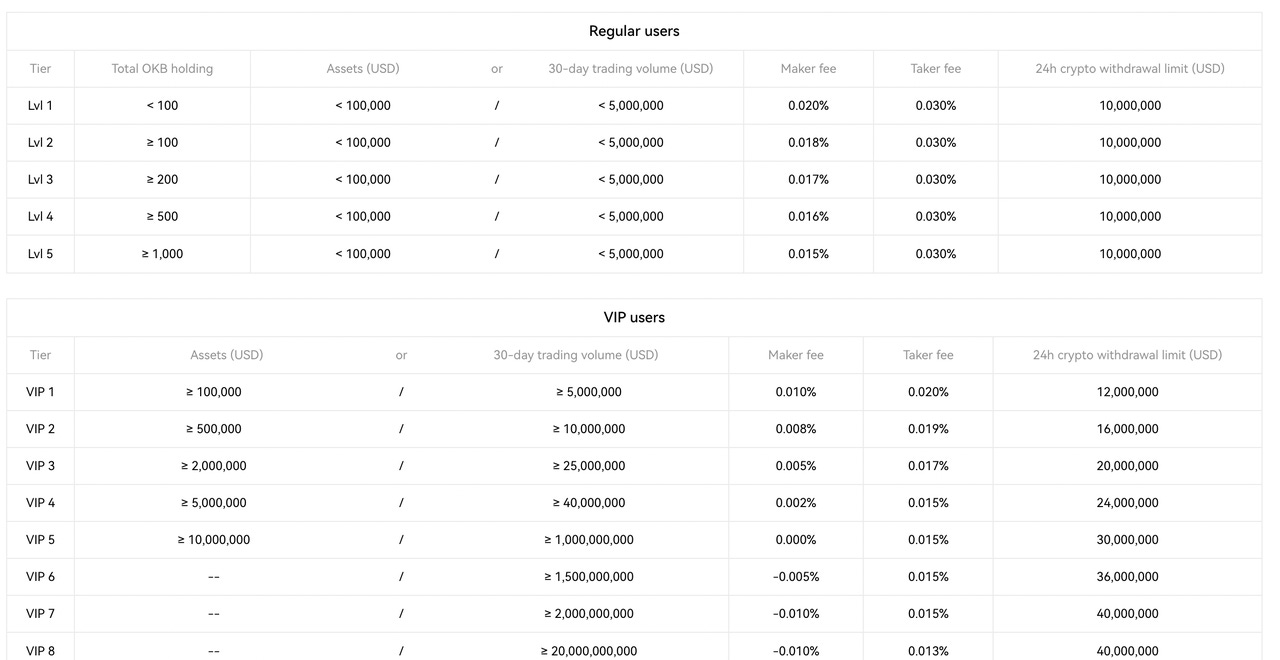

OKX’s fee structure is adjusted according to the user’s account level, divided into two categories: Regular users and VIP users.

Regular users: This level is divided according to the number of OKBs they hold, from Lvl 1 to Lvl 5. The more OKBs they hold, the lower the transaction fee. Maker fee decreases from 0.08% to 0.06%, and the taker fee decreases from 0.10% to 0.06%.

VIP users: This level is divided according to the account assets and the transaction volume within 30 days. VIP 1 to VIP 8 users enjoy lower transaction fees, and the maker fee is gradually decreased from 0.045% to -0.005%. As the level upgrades, users’ 24-hour cryptocurrency withdrawal limit is also gradually increased from $12 million to a maximum of $400 million.

Derivatives trading

Futures/perpetual

OKX’s futures trading platform ranks third in terms of trading volume, with a daily trading volume of $20 billion, and offers about 200 futures token trading pairs. The standard maker fee and taker fee are 0.02% and 0.05%, respectively.

OKX’s futures trading fees are adjusted according to the user’s account level, which is divided into two categories: Regular users and VIP users.

Regular users: Account levels are divided based on the number of OKBs held by the user or the 30-day trading volume. From Lvl 1 to Lvl 5, the more OKBs held or the larger the trading volume, the lower the trading fees enjoyed by the user. Maker fee decreases from 0.020% to 0.015%, while taker fee decreases from 0.050% to 0.030%. The 24-hour cryptocurrency withdrawal limit remains at $10 million per user level.

VIP users: VIP levels are mainly based on account assets or trading volume within 30 days. The higher the trading volume, the more favorable the fees. VIP levels range from VIP 1 to VIP 8, with a minimum maker fee of -0.005% and a minimum taker fee of 0.015%. Meanwhile, the 24-hour cryptocurrency withdrawal limit for VIP users increases from $12 million to $400 million as the level increases.

Pre-market Trading

Pre-market trading refers to the trading of futures or tokens before they are officially listed for spot trading. In pre-market futures trading, the token price before spot listing is based on the last transaction price of futures on the OKX platform. Once the token starts trading on the Spot Market, OKX will use index rules to calculate a comprehensive index price based on the spot prices from multiple exchanges. This index price will be used to calculate the settlement amount when the futures expire.

Options

OKX’s options trading fee structure is divided into Regular users and VIP users according to their account level, which is determined by their assets or 30-day trading volume. The maker fee for regular users decreases from 0.020% to 0.015%, while the taker fee remains at 0.030%. VIP users enjoy more favorable rates, with a minimum maker fee of -0.010% and a minimum taker fee of 0.013%. As the level upgrades, the user’s 24-hour withdrawal limit increases from $12 million to $400 million. In addition, transaction fees are calculated based on option premium, contract size, and quantity. Exercise fees are charged only on the exercised options, and no charge on the unexercised options. The liquidation fee is calculated on the user’s taker fee and market conditions. This mechanism encourages large transactions while ensuring market liquidity and system stability.

Copy Trading

OKX allows traders to copy the trades of other professional investors in the market. The target audience for copying trades is divided into followers and master traders. Followers will copy the trading strategies of the master trader they have chosen. Master traders can promote their strategies, attract followers, and receive a certain percentage of the net profit earned by each follower on OKX, depending on the level of the master trader.

Trading robot

OKX trading robots help users execute trading tasks on the market through automated strategies. They automatically execute buy and sell orders based on set parameters to achieve specific investment goals or optimize returns under market conditions. OKX offers a variety of trading robot tools for different trading strategies and market conditions: Spot Grid, Futures Grid, Intelligent Arbitrage, Spot DCA, Futures DCA, etc.

OKX Earn

OKX Earn allows users to earn passive income on crypto assets by participating in various interest-bearing products. These products vary according to risk and return and are suitable for various investment strategies. OKX Earn includes options such as staking, savings, and structured financial products.

Snowball: This is a structured product that offers higher potential returns while limiting risk. Depending on market trends, users can accumulate returns if the asset price remains within a specific range.

Snowball HODL: Similar to Snowball, designed for users who want to hold cryptocurrency (HODL) for the long term. During the lock-up period, the product can provide higher returns if market conditions are favorable.

Dual Investment: A short-term investment tool that allows users to deposit one asset and receive returns on another asset based on market price, suitable for hedging or speculating on price fluctuations.

Seagull: A structured product that combines multiple options, usually providing Downside Risk protection while limiting potential returns. It is suitable for users who expect slight or moderate price fluctuations.

Shark Fin: This product is designed to provide a minimum guaranteed return with the potential for higher returns based on asset price performance. If the price remains within a predetermined range, the return will increase and is shaped like a “Shark Fin”.

Borrowing

OKX provides borrowing services for individual and institutional users. Users can use cryptocurrencies such as Bitcoin and Ethereum as collateral to borrow other digital assets for trading or investment while maintaining ownership of the original crypto assets. The service provides flexible collateral options and borrowing amounts, allowing users to choose different loan terms according to their needs without credit checks.

JumpStart

OKX’s own Launchpad platform has successfully raised over $5.70 billion and supported the financing of 14 projects, including well-known ones such as Runecoin, Sui, and NOTcoin. Users can participate in new token offerings on Launchpad by subscribing to them with their crypto assets (e.g., BTC or ETH). These projects are typically newly launched ones, and users participate in token distribution by locking their assets. This method not only provides funding support for new projects but also provides users with the opportunity to gain potential revenue through early participation.

OTC Trading

OKX’s OTC block trading service is an over-the-counter format designed for high-net-worth market participants, allowing them to buy and sell assets in bulk without affecting market prices. Typically, OTC block trading involves institutional investors, hedge funds, or relatively wealthy individual investors. When these traders wish to buy or sell large assets, they submit a request for quote (RFQ) to the block trading platform. The platform (usually a broker-dealer) will break down the transaction into smaller blocks and the market maker will provide the execution price. If the trader accepts the price, the transaction will be executed off-exchange and will not appear in the open market order book, thus avoiding market price volatility.

OKX Ventures

OKX Ventures is the investment arm of OKX, focused on driving innovation and growth in the blockchain and Web3 ecosystem. OKX Ventures invests in projects across various fields including infrastructure, DeFi, NFT, and decentralized storage. The portfolio includes a few high-profile projects: Celestia, zkLink, io.net, ether.fi.

Binance: The Leader in Global Liquidity

Web3 Wallet

Binance’s Web3 wallet provides similar features and services as Bybit and OKX’s Web3 Wallet. However, the Binance Web3 wallet does not support downloading plugins to the browser through the Chrome Extension Store but requires users to download them through the Binance app, which invisibly raises the barrier to use and complicates access for users.

BNB multi-chain structure

BNB Chain is a multi-chain architecture system, mainly including BNB Beacon Chain (BC), BNB Smart Chain (BSC), and BNB Greenfield, and its performance is enhanced through two L2 scaling solutions, opBNB and zkBNB.

BNB Beacon Chain is responsible for the governance and management of the BNB chain. It is developed with Cosmos SDK, supporting BNB native asset issuance, token management, and on-chain decentralized exchange (DEX).

BNB Smart Chain has compatibility with EVM, and supports smart contract migration and high-throughput low-transaction-fee operations. As a multi-chain hub, it realizes cross-chain interoperability.

BNB Greenfield, as a decentralized storage chain, combines data storage with financial assetization to create new value opportunities for users.

zkBNB improves privacy and scalability through zero-knowledge-proof technology, reducing transaction fees.

opBNB provides developers with more innovative tools and services to further expand the ecosystem.

Exchange

Binance Exchange has a daily trading volume of over $8 billion, ranking №1 globally in spot trading with a market share of over 30%. It’s also №1 in futures trading with a market share of about 25%.

Spot trading

Binance offers more than 400 spot token trading pairs and supports about 10 fiat currencies. The basic maker or taker fee is 0.1%.

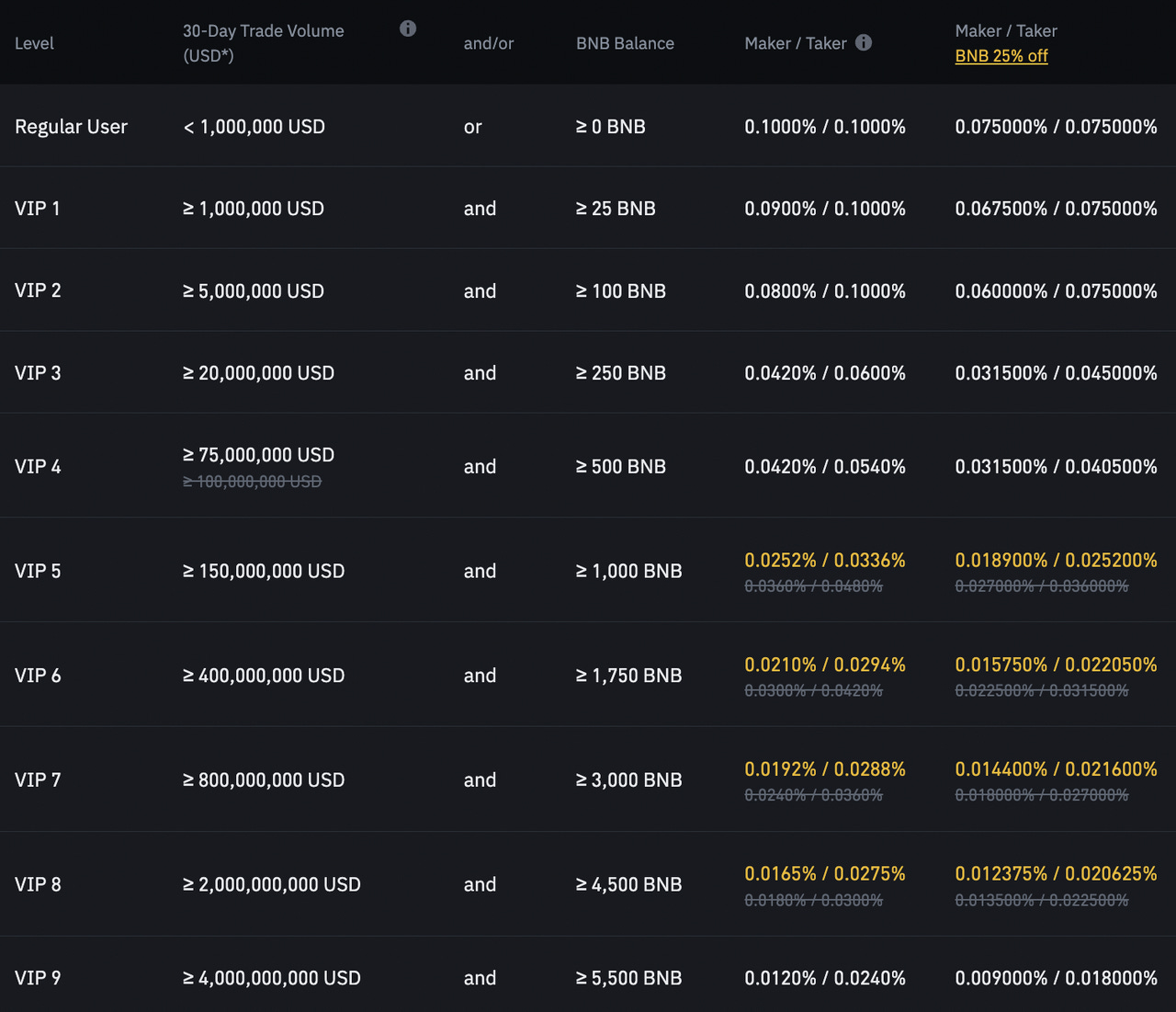

Binance spot trading fee structure is based on the user’s 30-day trading volume and the number of BNB balances. It is divided into different levels according to the user’s level, including taker fee and maker fee. For regular users (trading volume<$1 million and BNB≥0), both the taker fee or maker fee are 0.1%. VIP users enjoy lower fees based on their trading volume and BNB holdings. For example, VIP 1 requires trading volume ≥ $1 million and BNB ≥ 25 for a 0.09% taker fee, and using BNB as payment can enjoy a 25% discount. As VIP level upgrades, fees gradually decrease. VIP 9 users can enjoy 0.012% of the maker fee and 0.018% of the taker fee.

Derivatives trading

Futures/Perpetual

Binance futures trading platform ranks №1 in terms of trading volume, with a daily volume of $23.30 billion and offers 400 futures token trading pairs. Standard maker and taker fees are 0.02% and 0.05% respectively.

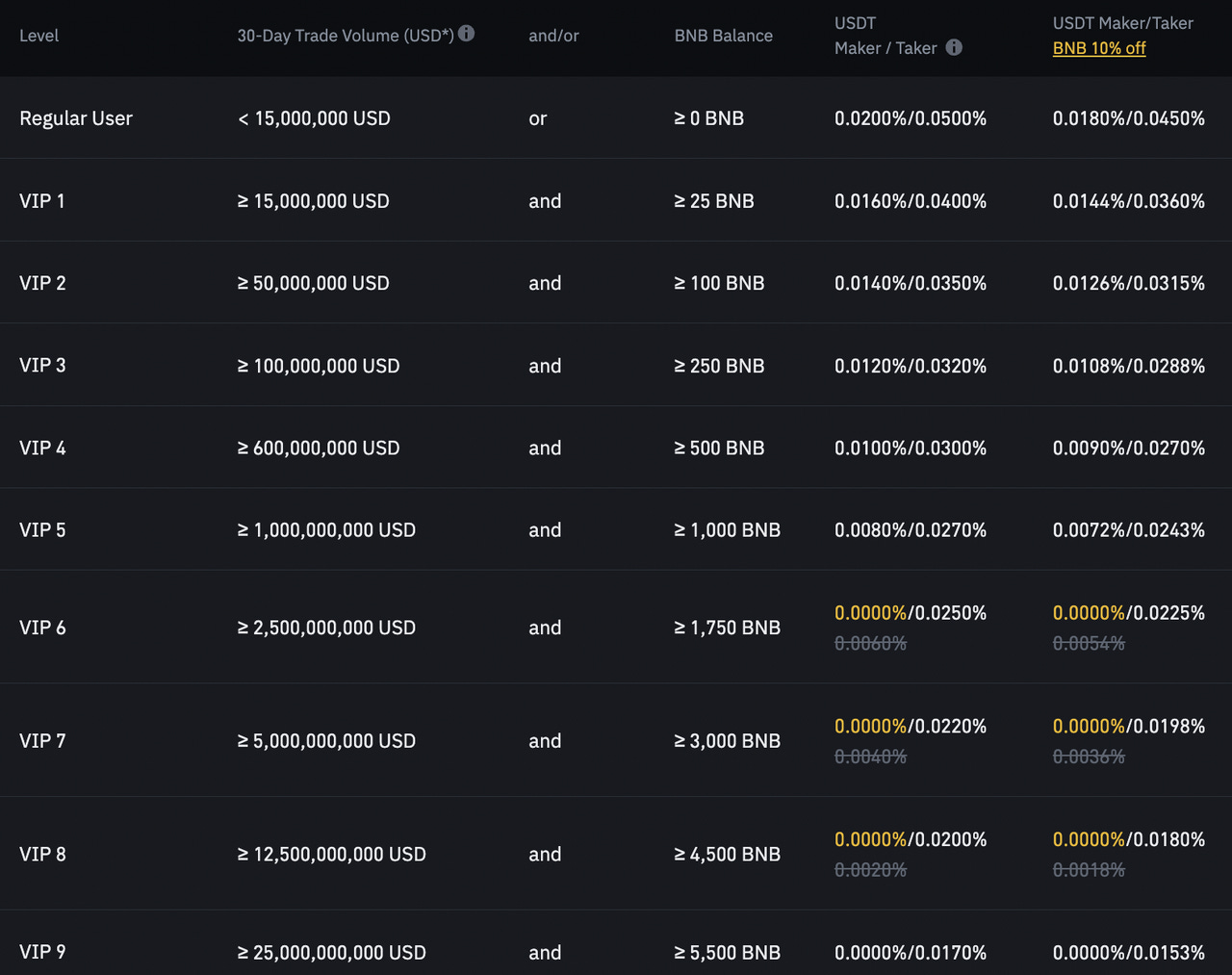

Binance Futures trading fee structure is based on the user’s 30-day trading volume and BNB balance, which is divided into maker fee and taker fee. For regular users (trading volume < $15 million and BNB≥), the maker fee is 0.02% and the taker fee is 0.05%. VIP users enjoy lower fees based on their trading volume and BNB holdings. For example, VIP 1 requires a trading volume of ≥ $15 million and BNB ≥ 25 for a 0.016% maker fee and 0.04% taker fee. As the VIP level upgrades, the fees gradually decrease, and VIP 9 enjoys free maker fees and 0.0170% taker fees.

Options

Binance options trading fee structure is also ranked by the user’s 30-day trading volume. The maker or taker fee for all users is 0.03%.

Pre-Market Trading

Binance Pre-Market trading allows users to trade before the official token launch. Launchpool users can lock in profits by selling their tokens from Launchpool rewards early through the pre-market, while non-Launchpool users can also buy and sell tokens through the platform before token launch. This feature provides users with the opportunity to seize the opportunity in the crypto market, especially as Pre-Market trading is set to become popular in the context of Binance Launchpool’s historically high returns.

Launchpool

Binance Launchpool returns have always been considerable, averaging about 2.75%, which usually drives the growth of BNB holdings as well as the rise of the token price. Historically, more than 100 projects have been listed on Launchpool and have raised over $180 million in total. The main method to obtain new tokens is staking FDUSD and BNB, which not only helps new projects obtain initial funding but also allows users to be engaged in new projects before token launch, further accelerating the development of the entire Binance ecosystem.

Megadrop

Binance Megadrop is a new token launch platform that allows users to earn early shares of Web3 projects before token listing on Binance. Users can earn points through BNB, and the longer the lock-in time and the more lock-in amount, the more rewards they will receive. In addition, users can also increase their points by completing Web3 tasks.

Binance Pay

Binance Pay is a cryptocurrency payment solution that allows users to instantly send and receive cryptocurrency payments without any fees. It supports over 200 cryptocurrencies and allows users to use Binance Pay for personal transfers, global online and offline store payments.

In terms of transaction fees, Binance Pay does not charge any transaction fees for personal transfers and payments between users. However, merchants using Binance Pay might be charged a fee based on their integration settings.

Copy Trading/Trading Bots/Binance Earning

Basically consistent with Bybit and OKX.

Loan

Binance Loans allows users to borrow cryptocurrency or stablecoins using existing digital assets as collateral.

Binance Loans offers three products: Flexible Loan, Fixed-Rate Loans, and VIP Loans.

Flexible Loan: Allows users to obtain more liquidity on top of existing crypto assets. The loan product supports segregated collateral, allowing users to hold the loan indefinitely by maintaining a defined “loan-to-value” ratio. In addition, users can still earn APY rewards through Binance Earn.

Fixed Rate Loan: Provides stable and predictable fixed interest rates, suitable for users who wish to borrow or lend stablecoins. The APY is fixed during the loan period, which enables a more stable experience for users .

VIP Loans: An institutional-grade service designed for Binance VIP users that supports fixed and flexible rates, allowing the asset to be aggregated across multiple accounts for greater capital efficiency.

OTC Trading

Binance OTC trading service provides institutional-level liquidity and supports large orders. Users can be engaged in large spot trades via Spot API RFQ (Request for Quote) to access liquidity for the trading pairs not listed in the spot order book. In addition, it supports 24/7 real-time price quotes via REST API connections. Futures RFQ and basis trading allow users to execute spot-futures basis trading across perpetual and quarterly contracts in a single transaction, avoiding the risk of partial fills. The algorithmic order platform reduces slippage and optimizes execution through strategies such as Time-Weighted Average Price (TWAP). The options RFQ service provides real-time option prices and supports personalized quote trading.

YZi Labs (previously Binance Labs)

Binance’s venture capital fund focuses on infrastructure and DeFi, with well-known projects in its portfolio including Aptos, Altlayer, and Layerzero. Its investment size mostly ranges from $10 thousand to $10 million, with leading projects above $10 million accounting for about 10% of its portfolio.

Company Acquisition

Binance has expanded its ecosystem through a few acquisitions, including several well-known platforms and tools.

Coinmarketcap

Binance acquired CoinMarketCap in 2020, which is a leading global crypto-asset price tracking platform that provides market information on various cryptocurrencies.

Trust Wallet

In 2018, Binance acquired Trust Wallet, a crypto hot wallet that allows users to fully control their funds. Trust Wallet’s key features include a built-in decentralized application (DApp) browser, as well as crypto staking and exchange directly within the app.

Swipe

Binance acquired payment platform Swipe in 2020 and jointly launched the crypto Visa card, driving the application of cryptocurrency in real-world payments.

Exchange Acquisition

Binance has also acquired some local exchanges, including Sakura Exchange BitCoin in Japan and Tokocrypto in Indonesia, and continues to maintain its operations locally and expand into global markets.

Coinbase: compliance-driven institutional service provider

Web3 Wallet

Features are the same as OKX and Bybit Wallet and support integration in Chrome Extension Store.

Layer 2 — Base

Base is an Ethereum Layer 2 scaling solution launched by Coinbase, designed to provide faster and cheaper transactions while maintaining the security and decentralization of Ethereum. Based on Optimistic Rollup, Base batches a large number of transactions and submits them to the Ethereum mainnet, dramatically reducing the transaction costs. Currently, Base’s total DeFi lock-up volume has reached $4.08 billion, with Aerodrome being the decentralized exchange with the highest TVL on the chain, with a lock-up volume of $871 million. Base occupies nearly 40% of the entire L2 market with an average gas fee of $0.00012 per transaction, which is lower than the average of all L2 solutions.

Exchange

Coinbase has a daily trading volume of approximately $1.3 billion and is ranked №6/№7 globally in spot trading volume for the month. Given Coinbase’s emphasis on compliance, it currently only serves the US region.

Spot trading

Coinbase offers 250 spot token trading pairs, only supporting fiat in USD, GBP, and EUR. The basic maker and taker fees are approximately 0.4% -0.6%.

In Coinbase’s transaction fee structure, the taker fee rate is 0.60% and the maker fee rate is 0.40% for small volumes e.g. < $10,000, . For larger volumes, such as $1M to $15M, the taker fee decreases to 0.18% and the maker fee is 0.08%. As the trading volume increases to over $400M, the taker fee decreases to 0.05% and the maker fee is completely waived. This tiered system encourages more high-frequency and large-volume traders to be engaged in trading by reducing the fees for large transactions.

Futures/Perpetual

Coinbase futures trading charges a unified 0.05% commission for both takers and makers.

Coinbase Earn

Consistent with Bybit, OKX, and Binance.

Coinbase One

Coinbase One is a monthly subscription service launched by Coinbase. Subscribers enjoy zero transaction fees, more staking rewards ( in ADA, ATOM, SOL, and XTZ), crypto market analysis and discounts from partners, 24-hour customer support, and a simplified crypto tax declaration process.

Private Client

Coinbase Private Client Server is a premium service for ultra-high net-worth individuals, personal investment vehicles, trust funds, and family offices. It provides personalized support with a dedicated account manager to assist with account opening and management, as well as institutional-level research and insights through coverage teams. To ensure asset security, the service integrates segregated cold storage hosted by Coinbase and provides insurance policies. In addition, Coinbase Private Client also provides physical and cyber security protection, regular financial and security audits, and supports multi-user account access, allowing team members to manage accounts and set different access permissions.

Coinbase Institutional

A comprehensive suite of services is available to institutional clients, including investing in digital assets through Coinbase Prime and deep liquidity across multiple trading venues. The platform also provides custody solutions, ensuring asset security through Coinbase Vault storage and regular financial and security audits. Customers can also use staking options and take part in governance through manual or delegated voting.

Coinbase Prime

A solution for institutional investors. Coinbase Prime helps clients connect to multiple exchanges and trading venues, simplifying the process of executing trading strategies. It also provides comprehensive financing services, supporting cryptocurrency lending, margin trading, and short selling. In addition, the platform supports secure custody of over 430 assets, making it one of the largest regulated qualified crypto custody services. Users can freely withdraw or deposit assets from cold wallets for staking or governance. With over 250 tradable assets, a quarterly institutional trading volume of $346 billion, and total custody assets of $404 billion, Coinbase Prime is a trusted solution for institutional trading.

Coinbase Card

Coinbase Card is a Visa credit card available to US residents. Users can use this card to spend cryptocurrency (including USDC) and US dollars anywhere Visa is applicable, supporting cash and cryptocurrency transactions. There are no application fees or credit checks during the application process.

Coinbase Commerce

Coinbase Commerce is a digital payment service provided by Coinbase that allows merchants to accept multiple cryptocurrency payments. Customer payments go directly into the merchant’s crypto wallet, and the platform seamlessly integrates with e-commerce platforms such as Shopify and WooCommerce. The service eliminates fraud risks through on-chain payments and reduces the costs for traditional payment processing, such as foreign exchange fees. Merchants are required to pay a 1% transaction fee and may incur network processing fees. They can also choose to convert cryptocurrency to fiat money.

Coinbase Ventures

Coinbase Ventures is the investment department of Coinbase, focused on investing in early-stage crypto and blockchain startups. So far, Coinbase Ventures has invested in over 300 projects, mainly in infrastructure, decentralized finance, and centralized finance. Notable investments include Animoca Brands, Aptos, Eigenlayer, etc.

Skew

Skew is a Data Analysis platform focused on the crypto market. It was integrated into Coinbase Prime in 2020, allowing clients to track the crypto spot and derivatives markets in real-time.

Bison Trails

Bison Trails is now part of Coinbase, providing advanced blockchain infrastructure solutions that enable developers and companies to build, operate, and scale blockchain applications. Their service focuses on simplifying blockchain participation and reducing related risks.

The Coinbase Developer Platform (CDP) provides APIs that allow users to query rich on-chain data on the Base network. Users can directly access these APIs or use them through the CDP SDK. Its services cover multiple application scenarios.

Wallet Management: Create and manage wallets through programming, supporting trading applications, AI wallets, etc.

Fiat to crypto conversion: Enable users to seamlessly convert fiat to cryptocurrency through the app.

Transaction fee payment: Provide users with no gas fee experience on the Base network and support transaction payment.

Staking service: programmatic staking is implemented in applications across protocols through a unified API.

Research on the Evolution and Breakthrough Strategy of Platform Tokens in Exchanges

To further understand the correlation between CEX’s platform token and its exchange operation performance, we analyzed the performance of the platform token at the following levels.

Bybit

$MNT Tokenomics

$MNT, as Mantle’s native token, currently accounts for more than half of the total market value in circulation, and the rest is managed by Mantle Treasury. Each newly released $MNT needs to be approved by the Mantle Treasury vote.

Mantle Treasury

According to the financial report of Mantle Treasury in the past year, the $MNT and $USDC reserves in the treasury are both in a state of floating deficit. Among them, the $MNT reserve lost about $3.03M in one year, and the main expenditure was the Ecosystem Builder Program related to ecological construction, which cost about $53.47M.

In terms of USDC reserves, the annual loss is about $9.69M, mainly used to pay for Mantle DAO’s labor costs, with an amount as high as $14.37 M. Overall, the treasury has lost about $12.72M in the past year.

In addition to relying on financing and working capital advances, according to Artemis data, the revenue of the Mantle public chain in the past year was about $2.1M, which is still not enough to cover the treasury expenses. To maintain the normal operation of the public chain, Mantle has adopted a high-expenditure strategy. However, these expenses have limited contribution to the overall revenue and have increased the financial burden.

Since the operation of the Mantle is currently in a negative expectation value, why does Bybit still choose to continue operating the Mantle? The following analysis will explore whether the Mantle can bring enough traffic to Bybit to support its development so that Bybit can retain and invest in its on-chain ecosystem building, rather than choosing to give up this business.

$MNT Historical Price

Firstly, by observing the price trend of $MNT and the performance of Bybit’s user growth, there is no obvious correlation. The price fluctuations of $MNT are mostly consistent with the overall market trend. For example, the recent price increase in November was mainly affected by Trump’s election, rather than Bybit reaching the user milestone. From the perspective of price trends, Bybit is not the main catalytic factor for $MNT.

2024.01.12 Launched Mantle Network v2 testnet on Sepolia, reserving the modularization design, using Mantle DA powered by EigenDA to improve performance and reduce costs, while secured by Ethereum.

2024.01.25 Stargate cross-chain bridge launch and users who bridge to Mantle Network for the first time through Stargate can receive 1 MNT token reward to pay for gas fees.

2024.02.26 Upgrade Mantle Network Goerli testnet from Mantle-v1 to Mantle-v2 codebase.

2024.03.15 Completed Mainnet v2 Tectonic upgrade, improving interoperability with EVM chains in the OP Stack ecosystem and offering one of the lowest gas fees in Ethereum L2 solutions.

2024.04.29 Launch the mETH User Dashboard to allow mETH holders on Mantle L2 to track and earn rewards starting with EigenLayer Points re-staked by Mantle Treasury.

2024.08.29 Launch of Pendle MNT Pool, allowing LP MNT or YT MNT holders to accumulate MNT Power (MP) through Mantle Rewards Station to earn ecosystem rewards.

2024.10.15 Completed the $EIGEN airdrop for eligible users holding $USDe on Pendle, and distributed a total of 2,098,636.67 $EIGEN rewards to eligible $mETH holders.

2024.11.11 Enabling the governance voting feature of $MNT locked in Mantle Rewards Station, increasing community engagement and determination inclusiveness, creating a stronger community-driven network.

2024.12.06 Launch a new Mantle Rewards Station rewards campaign, in partnership with Ethena, to reward users who lock in $MNT with 4 million $ENA, continuing the first event’s success by offering 2.50 billion Ethena Shards.

The above summarizes the crucial milestones of Mantle Network in the past year, which can be roughly divided into two stages: the first half of the year mainly focused on public chain upgrades, including integrating Stargate to achieve cross-chain transactions, and multiple network upgrades to improve efficiency and become a more powerful Layer2. During this period, the price of $MNT increased by more than 60%.

Subsequently, Mantle began to participate in the heavy staking of EigenLayer, allowing users to earn airdrop points by providing mETH while pushing the coin price to a historical high of 1.41 dollars. However, during the handover period in the first and second half of the year, Mantle lacked major upgrades or milestones, and coupled with the overall market uncertainty, the price of $MNT fell to the bottom, hitting a low of 0.56 dollars, almost wiping out all the gains in the first half of the year.

With the market entering a period of interest rate cuts and external factors such as Trump’s election, the price of $MNT has rebounded again. Mantle has also empowered $MNT, partnering with Ethena to pledge $MNT for $ENA rewards. Currently, the price of $MNT remains at around 1.12 dollars.

Position Performance

$MNT is highly controlled. The holding ratio of Whale Wallet has been maintained at about 90% for a long time, with the other 9% held by early investors and only 1% held by retail investors. This makes the ups and downs of the token price entirely depend on the manipulator’s preference. However, as of now, $MNT has not shown a significant price increase.

After in-depth research, it can be found that nearly 90% of the wallet addresses are Bybit and Mantle internal ones, indicating that token chips are still highly concentrated in initiators, and the circulating tokens are quite limited.

Due to the high concentration of tokens and the lack of liquidity from market makers, the token price is easy to manipulate. From the data, nearly 90% of $MNT holders have been profitable for a long time in the past year. Only in September, when the market price fell, did up to 75% of holders suffer losses. Of course, this 90% profit mainly comes from Bybit or Mantle Foundation holdings. This is also one of the common manipulation methods of platform tokens.

mETH deployment

Mantle, as the infrastructure of Bybit to provide services on-chain, has not been engaged in the popular sections of the current trend. For example, it has hardly been involved in the deployment of AI agents or meme coins. The only exception is the mETH Protocol, which seems to still be the main focus of public chains. It has also had substantial cooperation with Bybit, and holding mETH in Bybit Web3 Wallet can get $COOK airdrops.

Basically, mETH Protocol is a project that focuses on Eth staking and provides cmETH for re-staking. Although the EigenLayer craze has passed for more than half a year, Mantle’s official X platform still occasionally reposts articles related to Meth Protocol. In contrast, Mantle has not shown any substantial attention to AI agents and meme coins.

Nevertheless, the proportion of mETH Protocol in the entire ETH staking section is still quite small, only about 1.2%. It indicates that the core business development of Mantle is still weak compared to other competitors in the market, and cannot demonstrate obvious advantages.

The only thing worth looking forward to is that Bybit CEO Ben has stated that more features will be added to $MNT in the future, such as making $MNT the engaging token in Launchpool, in order to create an influence similar to $BNB in Binance Megadrop. This move is expected to significantly increase the demand for $MNT and drive new growth.

OKX

$OKB Tokenomics

As the platform token of OKX, $OKB is currently fully circulated while mostly held by the team and early investors. The so-called 60% ecosystem funds are actually controlled by the team and mainly used for future campaigns and rewards. The main use case of $OKB is closely related to the exchange, such as enjoying transaction fee discounts, participating in Launchpad campaigns, etc. However, OKX Jumpstart users can also participate by holding BTC and ETH, which greatly weakens the actual use value of $OKB.

$OKB Token Distribution

Similar to $MNT, although 10% of $OKB is nominally held by the foundation, most of the circulation is still controlled by the market makers. Except for the 46.72% burnt by the OKB Buyback & Burn plan, the largest 19 wallets are all OKX internal addresses, accounting for a total of 52.77%. Overall, including the burnt part, more than 99% of $OKB is still controlled by the official one and the actual circulation in the market is extremely limited.

The Buyback & Burn mechanism of $OKB is a deflationary strategy adopted by OKX exchange to increase the value of $OKB. Specifically, OKX regularly uses 30% of the transaction fee revenue from crypto transactions to repurchase $OKB from the secondary market and then transfers the repurchased $OKB to an inaccessible “black hole” address, permanently removing it from the circulating market.

$OKB Historical Price

The highest historical price of $OKB was $72.45. It is when BTC broke through the high of $69,000 in 2021 for the first time in the overall rising market, which benefits $OKB. Despite the OKX exchange user number exceeding 50 million in June 2024, $OKB as a tool for reducing transaction fees, its price has not seen significant growth and has remained around $32 for a long time. At the same time, the OKX Wallet, which was launched for a year, announced a user growth of up to 991% at the end of 2024. As this product did not empower $OKB, its impact on $OKB price was limited.

2024.02.27 OKX launches OKX TR exchange, providing Turkey users with a secure, compliant, and transparent crypto trading and DeFi platform, and expanding OKX Web3 wallet services.

2024.04.16 OKX launches Layer-2 solution X Layer, integrates with OKX exchange and OKX Web3 wallet, supports asset cross-platform bridging and more than 200 dApps interactions.

2024.04.25: X Layer Ecological Update OKX expands the X Layer ecosystem, and enhances the cross-platform transfer capabilities as well as user experience and usability.

2024.09.30 OKX Web3 Mini Wallet Launches on Telegram OKX launches OKX Mini wallet in Telegram, further expanding the Web3 ecosystem and improving user accessibility.

2024.10.10 OKX obtains UAE operation license OKX officially launched with the license in UAE, becoming the first global crypto exchange to provide AED banking services, which provide convenient financial services for retail and institutional users.

2024.11.18 OKX enables SGD instant deposit and withdrawal through DBS Bank, further integrating the local financial system and improving trading convenience.

2024.12 OKX Web3 Wallet’s global user base surges by 991% and the decentralized trading volume increases by 20 times, further consolidating its influence on the DeFi field.

2024.01.23 OKX became the first exchange to be pre-authorized by MiCA (Markets in Crypto-Assets Regulation) to provide localized crypto services to over 400 million European users through its Malta headquarters.

The development direction of OKX exchange is centered on compliance, which shows that it has obtained operating licenses in multiple regions, which is difficult for many exchanges to obtain. However, we estimate that due to compliance requirements, OKX cannot give its platform coin $OKB too many securities attributes, resulting in a large amount of circulation still being held by the official. Even though the exchange’s business scale continues to expand, the application scenarios of $OKB have not expanded synchronously.

In addition, although OKX has invested heavily in the on-chain ecosystem, OKX Wallet has amazing user growth, and has its own public chain X Layer and OKT Chain, the actual application of $OKB is still limited. OKX Wallet has not deeply integrated $OKB. Although X Layer uses $OKB as a gas fee, the on-chain ecosystem is weak and the active level is low. OKT Chain even uses another token, $OKT, as a gas fee, further weakening the actual demand for $OKB and indirectly limiting its market value.

Position Performance

It can be seen that almost all holding addresses were profitable at the beginning of the year, but with the mid-year market correction, the proportion of profitable wallets once dropped to 33%. With the later recovery of the market, more than 90% of wallets are still profitable. However, as mentioned above, most of these wallets are held by OKX exchange internal or early investors, so they cannot truly reflect the overall trading situation of the market.

The Role of $OKB in OKX Jumpstarter

In the past, OKX Jumpstart has always used BTC or ETH as mining tokens. However, in the recent $Anime Launchpad campaign, $OKB was rarely reintroduced as a mining token with the allocation share of the staking pool exceeding 60%, higher than BTC. This change makes the expectation of $OKB continue to be empowered and gradually approach the core position of $BNB on the airdrop platform. In addition, the APY of the $Anime airdrop is as high as 355%. Even with only 3-day participation, the rate is still 2.91%, which has attracted widespread attention.

Binance

$BNB Tokenomics

As the platform token of Binance Exchange and the main Gas fee token of BNB Chain, $BNB has use cases including exchange ecosystem and on-chain applications. Compared with $MNT and $OKB, $BNB is the only token that can capture more value from public chain gas fees. $MNT has limited token burnt due to insufficient active level, while $OKB completely lacks on-chain empowerment to limit its ecosystem value.

The entire circulation of $BNB has been fully released while the initial allocation is still mainly controlled internally. Although holders are diversified, $BNB is still internally held, which results in a high concentration of market chips.

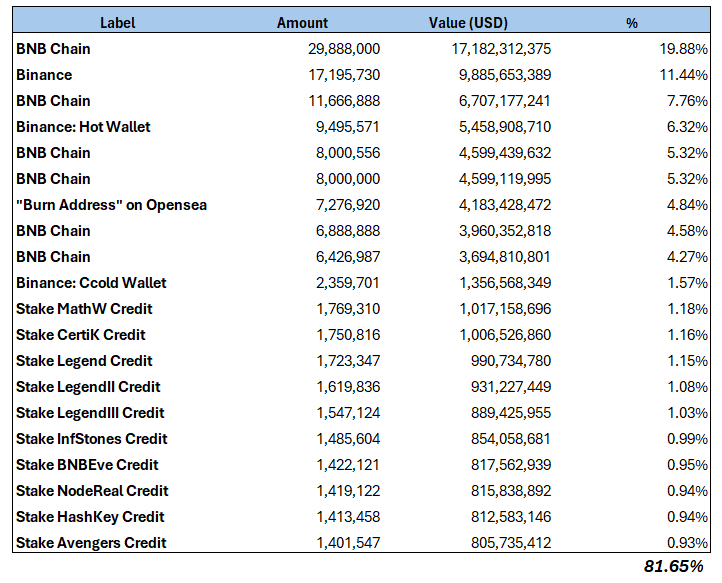

$BNB Token Distribution

BNB also has a similar situation, where most of the chips are concentrated in the hands of the market makers and stakeholders responsible for pledging. The top 20 token-holding wallets account for more than 80% of the token circulation, while Binance itself holds more than 60%, scattered in multiple wallets.

Due to the staking function of $BNB, the second largest stakeholders are mainly staking service providers and validator nodes. They participate in network consensus and obtain staking benefits by holding a large amount of $BNB.

Validator node: In the proof-of-stake consensus mechanism of the BNB Chain, validator nodes are responsible for verifying transactions, packaging blocks, and ensuring cyber security. Entities such as Legend, BNBEve, and Avengers are active validation nodes of the BNB Chain, holding a large amount of $BNB to support their node operations.

Pledge Service Providers: Companies such as CertificK, InfStones, and NodeReal offer $BNB staking services, allowing holders to entrust $BNB to them and participate in network staking to earn rewards without running nodes themselves.

Investment institutions: Institutions such as HashKey hold large amounts of $BNB for investment, participation in network governance, or providing liquidity support.

Token Burn Mechanism

BNB has adopted a deflationary token model. Currently, Binance uses two main methods to burn BNB.

Real-time Burn(BEP-95): A portion of the transaction fees on the BNB chain are burnt in real time. Since the Bruno upgrade, about 860 BNB is burnt per day.

BNB Auto-Burn: BNB Auto-Burn will be based on the $BNB price, reflecting supply and demand. The burning amount will be automatically adjusted based on the number of blocks produced in the quarter and the average $BNB price.

Burning formula:

B = amount of BNB to be burned

N = total number of blocks produced by the BNB chain in a quarter

P = the average $BNB price against the US dollar

K = constant value (initially set to 1000)

It can be seen that although the BNB chain itself holds most of the $BNB, part of it is a reserve as a burning mechanism. When the total circulation of BNB drops below 100 million, the burning will stop.

$BNB Historical Price

In the past year, the $BNB price has doubled, and the number of users has surged from 170 million in 2023 to 250 million by the end of the year, far more than other exchanges. Binance has also expanded its fiat-to-crypto service to 20 new countries, which has more than tripled the number of Binance Pay users at the end of the year. $BNB price is stable and has long been attractive to retail investors. In addition, Binance Launchpool often attracts a large number of buyers before the token listing, pushing the $BNB price up gradually.

2024.04.19 Binance Launches “Megadrop” Early Access Program

Binance has launched Megadrop, a Web3 rewards early access program designed to incentivize user engagement with new projects.

2024.04.30 Founder Zhao Zhangpeng Sentenced

Binance founder Zhao Zhangpeng (CZ) was sentenced to four months in prison after pleading guilty to violating the US Anti-Money Laundering Act.

2024.05.09 Binance fined CAD 6 million in Canada for violating AML regulations

The Canadian AML Agency fined Binance CAD 6 million (USD 4.38 million) for violating AML and terrorist financing laws.

2024.08.15 Binance resumes full operations in India

After a seven-month ban, Binance has finally resumed full operations in India.

2024.09.09 Binance Gets Full Operating Qualification in Argentina

Binance has obtained the Virtual Asset Service Provider (VASP) license issued by the Argentine National Securities Commission (CNV), becoming the 20th region in the world to obtain regulatory approval for Binance.

2024.09.09 Binance’s Tokocrypto Receives Full License in Indonesia

Binance subsidiary Tokocrypto has been granted a Crypto Asset Trading License (PFAK) by Bappebti, Indonesia, ensuring full compliance with local regulations.

2024.10.01 Binance and Circle Reach Global Stablecoin Expansion Cooperation

Binance partners with Circle to expand USDC supply, enhance liquidity, and advance global financial services development.

2024.12.11 Binance Receives 21st Global Crypto License in Brazil

Binance receives regulatory approval in Brazil to successfully acquire São Paulo’s Simpaul, a Financial Institution with a Securities Brokerage and Electronic Money Publishing (EMI) mandate.

2024.12.18 Australia files lawsuit against Binance

The Australia Securities and Investments Commission (ASIC) has filed a lawsuit against Binance, accusing it of misclassifying 505 retail users as wholesale users and failing to provide user protection.

2025.01.02 French authorities launch fraud investigation into Binance

French regulators have launched an investigation into Binance, accusing it of money laundering, drug dealing, and tax evasion between 2019 and 2024.

Binance can be said to be in a regulatory haze in the first half of 2024. With the founder CZ imprisoned for violating AML laws, the exchange’s operations have also encountered regulatory investigations in multiple regions around the world. In the second half of the year, after investigations and compensation, Binance gradually resumed normal operations and obtained operating licenses in Argentina, India, Indonesia, Brazil, and other places, gradually moving towards a compliant exchange business model. Of course, Binance still faces many challenges to achieve full compliance and was still under investigation and litigation in Australia and France at the end of the year. However, it is undeniable that Binance is still the world’s largest exchange, with trading volume accounting for over 40% of the market.

The Role of $BNB in Binance Launchpool

BNB, as a necessary collateral asset for Launchpool, has always been regarded as having the ability to “create wealth”, which is also a key factor in its stable price. This article summarizes the performance of Launchpool project tokens in the past three months to explore their investment returns.

From the data, the average participation time in Launchpool is about 2 to 4 days, with only two cases exceeding 10 days. However, the length of participation days does not directly determine the level of income. For example, if $TON participates for 20 days, the end user will receive a return of 6.55% (token price taken from the Closing Price 1 hour after listing); but if $BIO participates for 10 days, the final return is only 0.51%.

Overall, the average return of Launchpool is about 2.75%. Coupled with HODLer Airdrops providing additional airdrops for BNB holders, the overall holding return of BNB far exceeds that of other platform coins. This is also the core reason for the strong buying of BNB.

Another key point is that the slisBNB and clisBNB staked in Binance Web3 MPC Wallet will also be included in the Launchpool calculation range. This means that users do not need to sacrifice other revenue functions of BNB to participate in Launchpool at the same time.

This mechanism not only increases the overall return on holding BNB, but also provides higher asset flexibility, allowing users to enjoy Launchpool rewards while retaining other sources of BNB income.

Although the BNB Launchpool did drive the market demand for BNB, it is still worth exploring whether there is a direct correlation between it and the rise in BNB prices.

The above chart shows the Launchpool data for the past three months and tracks the rise and fall of BNB price from the token Launchpool announcement to the official start of the event. We believe that this period is often the most active period of market buying, so we conducted a Data Analysis.

The results show that the maximum increase in BNB price exceeds 10%, and even if there is a pullback, the decline is generally less than 1%, with relatively mild fluctuations. Of course, this analysis does not consider the influence of other market factors, but overall, the average increase in BNB during the Launchpool period is about 3.25%.

Horizontal Comparison

The characteristic of these three kinds of platform tokens all feature in centralization, with the ups and downs wholely depends on the determinations of the market makers. In the past year, the prices of $BNB and $MNT have both risen by more than 100% (doubled), and the trend is generally consistent without independent trends. BNB has been particularly aggressive, with a year-round increase of up to 130%. In contrast, OKB was able to keep up with the pace of the first two in early 2024 while remaining stagnant for half a year with the final price hardly changing.

Of course, we cannot directly judge whether the manipulator is pulling up the market, but the most intuitive indicator is the active level of token trading, which can be reflected in the trading volume. The above chart compares the trading volume of three types of tokens, and it can be seen that BNB accounts for more than 80% in the long term, while MNT maintains around 16%. In contrast, the trading volume of OKB is extremely low, with an average annual volume of only about 50.5M. The average annual trading volume of BNB is about 1.43B, and MNT is about 142.4M.

Regarding the platform coins of the three major exchanges, we also discussed the correlation between the trading volume of the parent company and the price of their platform coins. At the beginning of the year, Binance’s market trading volume accounted for about 77%, Bybit’s about 14%, and OKX’s about 9%, which is consistent with the proportion of platform coin prices.

Over time, from mid-June to July, Bybit’s Market Share gradually increased to over 20%, while Binance dropped to around 70%, with a low of 64% at one point, and Bybit reached a high of 25%. The market layout has changed. As of the writing of this article, Bybit’s market share is still stable at around 20%.

From the data, although Binance’s monopoly in overall trading volume is not as exaggerated as the trading proportion of BNB tokens, it still leads the other two exchanges. Bybit’s trading volume has increased in the later stage, consistent with the trend of gradually increasing MNT trading volume. Only OKX, although its overall Market Share is stable at around 10%, due to limited empowerment of OKB tokens and the exchange’s strategy leaning towards on-chain development, the overall platform coin price remains relatively stable.

Structural Dilemma of Platform Tokens

The current global crypto exchange (CEX) market shows a clear Matthew effect: Binance and Bybit’s spot trading volume account for 30% and 13% of the market share, respectively, while the fourth-tier exchanges are struggling to survive. Through the analysis of the platform tokens and business structure of the four leading exchanges (Binance, Bybit, OKX, Coinbase), we have found several structural issues worth paying attention to.

1.1 Value capture and liquidity dilemma

Platform tokens face a fundamental value capture paradox: except for BNB, most platform tokens have failed to effectively capture the value of the exchange ecosystem. Data shows:

BNB: It is used not only for transaction fee discounts, Launchpad, etc., but also as a gas fee on the BNB chain, realizing direct value capture, deflating the token through quarterly automatic destruction and a real-time burning mechanism, and the token value is positively correlated with the prosperity of the exchange business

OKB: Although used for fee discounts and OKX Jumpstart subscriptions, OKX’s Launchpad does not enforce the use of OKB, weakening its unique needs

MNT: As the Gas and governance token of the Mantle network, it theoretically carries the expectation of Bybit’s layout of Web3, but the current Mantle chain application is limited and has not been deeply integrated into the Bybit trading system

Analysis of the holding structure of platform coins shows serious concentration issues.

BNB: Over 60% is held by Binance officials, and the “Whale” account holds over 80% of the circulation

OKB: More than 99% is still controlled by OKX officials, except for the destroyed parts

MNT: The holding ratio of Whale Wallet has been maintained at about 90% for a long time, and retail investors only hold 1%.

1.2 Performance paradox of ecological active level

Layer2 solutions on various platforms face the paradox of performance not being proportional to the active level of the ecosystem.

Base (Coinbase): Daily active addresses reach 1.30 million

Mantle (Bybit): Daily active address only 50,000

X Layer (OKX): Lack of Lock-up Volume

In-depth analysis shows that although these public chains are constantly upgrading their technology, there is a significant deviation between investment and return. Taking Mantle as an example, according to financial reports, Mantle lost about 12.72M in the past year, and the 12.72M MNT and $USDC reserves in the treasury are both in a floating loss state. The revenue of the Mantle public chain is only $2.1M, which is far from enough to cover expenses.

Platform Token Performance and Value Drivers

2.1 Price performance comparison

In the past year, the price performance of platform tokens has shown significant differentiation.

BNB: Price growth of 130%, full-year transaction volume accounted for more than 80%

MNT: Price growth of about 100%, trading volume ratio stable at around 16%

OKB: Prices are flat, and trading volume is extremely low (only about 50.5M, compared to BNB’s 1.43B and MNT’s 142.4M)

It is noted that the price trends of BNB and MNT are highly synchronized, while OKB has long performed poorly, which is directly related to their respective usage scenarios and value capture mechanisms.

2.2 Correlation between user growth and token value

Analysis shows that the price of platform tokens is not necessarily related to the user growth of exchanges.

Binance users grow from 170 million to 250 million, BNB prices rise sharply

OKX announced that the number of users exceeded 50 million, with wallet user growth of 991%, but OKB prices did not increase significantly

When Bybit reaches the user milestone, MNT price fluctuations are mainly affected by the overall market trend

This indicates that the price of platform coins is more influenced by their actual application scenarios and value capture mechanisms, rather than simple user growth data.

The Structural Contradiction of Liquidity Efficiency

By analyzing trading data, we found that the cost paid by exchanges to maintain high liquidity is constantly rising. Taking the market maker rebate policy as an example:

Bybit divides market makers into three levels, and when the trading volume share reaches ≥ 0.5%, the commission is as high as -0.005%.

OKX’s VIP 8 user maker rate is -0.005%

Binance’s premium VIP users enjoy close to zero transaction fees

This “liquidity bidding war” is similar to the “burning money war” of the Internet era, and its sustainability is questionable. Exchanges are caught in a zero-sum game: competing for users by continuously reducing fees and providing rebates, damaging the overall industry profit level.

Analysis of the business structure of the four major exchanges

We have refined the business structure of the four major exchanges and discovered some interesting structural features.

Hierarchical analysis of revenue sources

After sorting through the data, we found that the revenue sources of the exchange show a clear “pyramid” structure.

Basic income layer (largest proportion)

Spot/derivatives transaction fee

Leveraged transaction fee

On-chain withdrawal fee

2. Value-added service layer (medium proportion)

Staking income

Lending service fee

Listing fee (mainly in the form of tokens)

3. Innovative business layer (small proportion)

NFT marketplace transaction fee

Data API service fee

Institutional services fee

Differentiated business mapping

We found that each exchange is trying to create a unique business model.

Bybit featured business matrix:

Pre-market trading (Cumulative Volume $35,698,815)

- IDO projects (35)

- Average rate of return > 2000%

- Participation threshold (points mechanism)

OKX differentiated layout:

Web3 ecosystem

- Wallet User (> 1 million Chrome Plugin Download)

- NFT Marketplace (Peak Daily Volume > 50 million USD)

- Sub-account function (independent deposit address)

Coinbase unique positioning:

Institutional service system

- Prime service (custodial assets 404 billion USD)

- compliance advantage (US market)

- Base Layer2 (DAU 1.20 million)

Binance business features:

Ecosystem integrity

- BSC Revenue

- Launchpool (≈ 100 projects)

- Pre-market trading

Quantitative processing of key indicators

According to the data, we have constructed the following quantitative indicator system:

1. User cost efficiency

Comparison of fee structure:

- Bybit: Spot 0.01%/Contract 0.02%

- Binance: Spot 0.1%/Contract 0.02%

- OKX: Spot 0.08%/Contract 0.02%

- Coinbase: Spot 0.4-0%/Contract 0.05%

2. Ecosystem active level

Layer 1/2 performance comparison:

- Base: 1.20 million DAU address

- Mantle: 10,000 DAU address

- OKT Chain: > 100 million total address

- BNB Chain: Multi-chain architecture

3. Innovative business penetration rate

Web3 wallet analysis:

- OKX: > 1 million downloads

- Bybit: Supports 20 + public chains

- Binance: Inherent integration

- Coinbase: Institutional Orientation

Data Correlation Discovery

Through cross-analysis, we found several noteworthy data correlations.

1.The inverse relationship between rates and market share

Although Coinbase has the highest fees, it still maintains a leading position in the US market

Bybit low-rate strategy helped it gain a 13% market share

2. On-chain ecosystem and user stickiness

Base high active level and Coinbase’s institutional strategy form a virtuous circle

Mantle low active level may affect Bybit’s ecosystem expansion

3. Innovative business and revenue structure

Pre-market trading is innovative but limited in scale

The trading volume of the NFT marketplace fluctuates greatly, and the revenue contribution is unstable

Characteristic analysis: Analysis of differentiation strategies of different exchanges

Through an in-depth analysis of the uniqueness of the four major exchanges, we found that each exchange is trying to build its own “Competitive Edge”. This differentiation is not only reflected in the surface product functions but also reflects their respective strategic positioning and development paths at a deeper level.

Bybit: The dilemma and breakthrough of functional innovation leaders