Logic Reconstruction and Redefinition of CommunityFi & ConsumerFi

I. Reconstruction and Definition of Key Concepts

The Essence of CommunityFi Drivers Reconstructed

Conventional wisdom holds that the core of CommunityFi is “community consensus.” However, a deeper analysis reveals that its true driver is the ability of community members to actively participate in content creation and influence decision-making, rather than mere social activity.

Redefining “Community Engagement Intensity”

Community engagement intensity should not be measured solely by the number of Discord messages, Telegram group members, or X (formerly Twitter) followers. Instead, it should focus on:

Content Contribution Rate: The proportion of community members spontaneously creating project-related content.

Decision-Making Involvement: The actual extent to which community members influence project direction.

Social Fission Efficiency: The number of new users a single community member can attract and their retention rate.

Take PEPE as an example, a memecoin that rose in 2023, themed around the well-known internet culture figure “Pepe the Frog.” Unlike traditional crypto projects, PEPE had no presale or developer tax and relied entirely on community consensus to fuel its growth. Its tokenomics is very simple, with a total supply of 420.69 trillion tokens, emphasizing meme culture and social fission propagation. PEPE exemplifies the synergy of community power and meme culture.

PEPE’s price is influenced by community consensus and market sentiment, which is highly consistent with the core logic of the CommunityFi section. Its success does not stem from technological innovation but from a market myth crafted by community-driven efforts, speculative sentiment, and social propagation. This success is not merely due to its 410,802 token holders, but rather the large amount of meme content and secondary creations spontaneously generated by the community. PEPE holders are not just investors; they are cultural propagators. Among its 789.2K followers on X, a significant portion actively creates and shares PEPE-related content, driving viral spread.

Similarly, Shoggoth, a meme coin on Solana, originated from H.P. Lovecraft’s novel At the Mountains of Madness, symbolizing the risks AI might pose. In December 2022, following ChatGPT’s release, the Shoggoth image entered the AI domain, and a community quickly adapted it into the $Shoggoth token on blockchain. Even during a bear market, when its market cap dropped from $200M to $5M, Shoggoth’s community remained active, continuously producing meme images, demonstrating deep identification with the project. This identification transcends simple speculation, reflecting genuine community-driven momentum.

The “Hidden Community Logic” Behind ConsumerFi

On the surface, ConsumerFi projects aim to address users’ daily financial needs, but their success often hinges on an underappreciated “hidden community logic” — establishing an implicit game structure based on economic interests between consumers and the platform.

Take TADA Taxi as an example. TADA is a blockchain-based ride-hailing platform in Singapore that offers low-cost, driver-friendly services payable with cryptocurrencies like $TON and $USDT via its Telegram Mini App. TADA effectively demonstrates how ConsumerFi can be integrated with blockchain and Web3 technologies to deliver innovative financial services, particularly in ride-hailing. Blockchain ensures all transactions (e.g., fares, subsidies, driver rewards) are recorded on an immutable ledger, enhancing transparency and reducing reliance on traditional payment processors or centralized platforms.

During the TOKEN2049 conference in Singapore, TADA invested approximately S$600,000 in subsidies, offering the first 4,000 users S$60 in free ride credits. This appears as a simple user acquisition tactic, but it effectively creates a temporary “community” within a specific scenario. These users not only enjoyed discounts but also became spontaneous promoters, generating word-of-mouth within the crypto community.

Henry Social is positioned as a crypto cashback platform, fostering a community-driven “gameplay” model with a strong focus on early community engagement. Its design encourages active engagement through a high-reward structure — offering up to 80% crypto cashback on purchases and up to 10% savings yield via DeFi. It incentivizes early adopters to treat the platform as a game where they can earn rewards (e.g., stablecoins like USDC) and explore opportunities such as deploying rewards into vault products, prediction markets, or memecoins, akin to interactive features in frameworks like Farcaster. This gameplay cultivates a highly engaged community from the outset, leveraging the novelty and excitement of cryptocurrency to drive participation.

StormX is a crypto cashback platform that allows users to earn up to 87.5% rewards in BTC, ETH, or other cryptocurrencies through online purchases, tasks, or staking $STMX tokens, aiming to make it easy for anyone to earn crypto assets anytime, anywhere. StormX allows crypto cashback on purchases, with rates ranging from 0.5% to 87.5% based on a user’s StormX Reward level. This tiered, flexible reward system not only meets consumers’ cashback expectations but also attracts early adopters interested in crypto assets.

In addition to cashback on purchases, the platform provides staking, token utilities, membership and governance features. These elements complement each other, forming a multidimensional ecosystem that allows users to go beyond the one-off shopping experience and gain long-term benefits and engagement through different channels. Combining blockchain with traditional e-commerce, StormX is positioned as both a solution for daily consumption needs and a gateway to the crypto-economic ecosystem. This dual positioning highlights its differentiation and secures an early market share in a competitive market.

While Henry Social and StormX focus on crypto cashback, their core strength lies in building a user network based on shared economic interests. Henry Social offers up to 80% crypto cashback and DeFi yields, while StormX provides cashback ranging from 0.5% to 87.5% based on Reward levels. These designs are more than incentives; they establish a “consumer community” where users benefit collectively through referrals and sharing, forming implicit community bond.

II. The Hidden Game Between Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

Definition and Measurement of Key Concepts

Before diving into the analysis, two core metrics need to be clearly defined:

Customer Acquisition Cost (CAC): The total cost of acquiring a new user, including marketing expenses, incentive costs, and operational expenditures.

Calculation: CAC = Total user acquisition costs in a specific period ÷ number of new users acquired.

In Web3 projects, CAC typically includes token incentives, airdrop costs, community operations, and marketing expenses.

Lifetime Value (LTV): The net value a user generates for the project over their entire lifecycle.

Calculation: LTV = Average monthly revenue contribution per user × average lifecycle (in months) × Gross margin.

In Web3 projects, LTV includes transaction fees, subscription revenue, ad revenue sharing, or value from network effects introduced by users.

CAC Recovery Period: The time required for a project to recoup its user acquisition costs.

Calculation: CAC Recovery Period = CAC ÷ (Monthly LTV × Gross margin).

Healthy Web3 projects typically recover CAC within 6–12 months.

Community-Driven Does Not Mean Low Cost

The market often assumes community-driven models are a low-cost acquisition strategy, but data suggests a more complex reality.

For instance, TADA Taxi’s user acquisition cost during the TOKEN2049 event in Singapore reached S$150/user (S$600,000 ÷ 4,000 users), which is much higher than traditional marketing channels. However, this high cost secured a precise target audience (crypto enthusiasts), who not only use the product themselves but also bring in more users through their community influence.

In contrast, Brave Browser adopts a different approach. Brave is a Chromium-based, privacy-first browser that blocks ads and trackers by default, offering a fast and private browsing experience. Through Brave Rewards and Web3 features (e.g., Brave Wallet, Brave Search), it enables users to earn BAT tokens and engage in decentralized finance, targeting a global audience with a secure and efficient online experience. By offering BAT token rewards, Brave has attracted over 80 million users. On the surface, it acquires users through economic incentives, but at a deeper level, its success lies in creating a user community around digital assets. Users not only enjoy the browsing experience but also participate in content creation and Web3 interactions via the BAT ecosystem.

Successful Web3 projects do not simply minimize acquisition costs, but rather build a high-quality social network through initial investment, which results in higher user value returns over the long term.

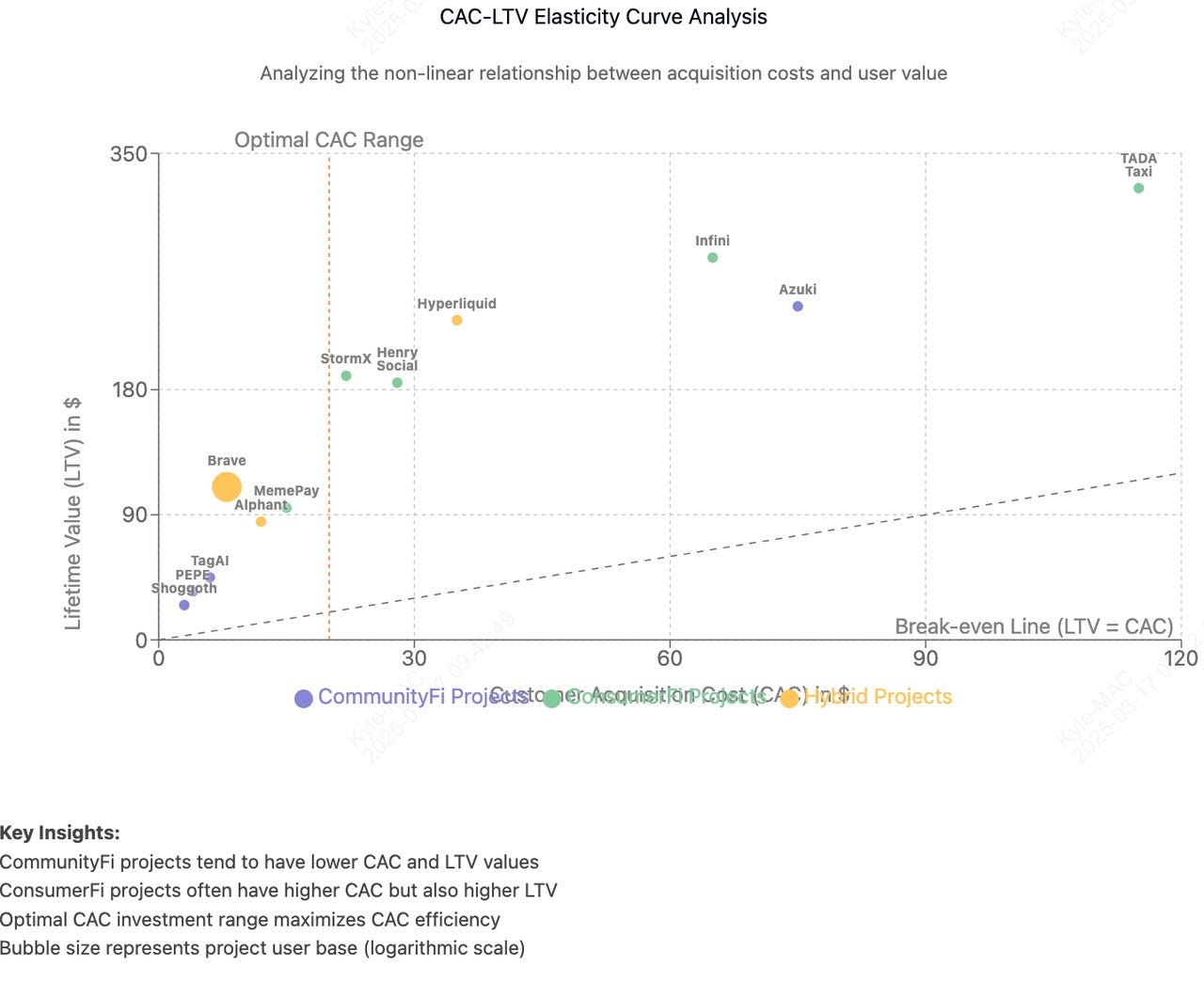

CAC-LTV Ratio Optimization Model: Key Metrics and Project Comparison

By analyzing data from multiple projects, we constructed a CAC-LTV ratio optimization model and defined specific quantitative metrics for each approach:

Model Definition and Key Metrics

High CAC-High LTV Model:

CAC Range: >$50/user

Target LTV: >$250/user

ROI Cycle: Typically 6–12 months

Key Success Metric: User retention rate >40% (90 days)

Representative Projects: TADA Taxi, Infini

2. Medium CAC-High LTV Model:

CAC Range: $10–50/user

Target LTV: $100–250/user

ROI Cycle: Typically 3–6 months

Key Success Metric: Product activity >30% (DAU/MAU ratio)

Representative Projects: Brave, Henry Social, StormX

3. Low CAC-Medium LTV Model:

CAC Range: <$10/user

Target LTV: $30–100/user

ROI Cycle: Typically 1–3 months

Key Success Metric: User growth rate >15%/month

Representative Projects: MemePay, certain meme coins, TagAI

Typical Project CAC and LTV Comparison

User Retention and Value Capture Efficiency Comparison

To deeply understand different projects’s user value creation capabilities, we analyzed their retention strategies and value capture efficiency:

1. TADA Taxi:

Retention Mechanism: Driver-friendly fee structure (no fees for fares <S$7, S$0.6 for fares S$7–18)

Value Capture Efficiency: Drivers retain up to 91.4% of revenue, which improves service quality and reliability

Effect: A stable driver base enhances passenger experience, creating a virtuous cycle

2. StormX:

Retention Mechanism: Multi-level reward system, user-friendly access channels (iOS/Android apps and browser extensions)

Value Capture Efficiency: Crypto cashback increases by level (up to 87.5%), incentivizing the usage

Effect: High-frequency consumption scenarios combined with substantial cashback boost user stickiness

3. Brave:

Retention Mechanism: Core privacy protection + BAT reward economic system

Value Capture Efficiency: Ad revenue shared directly with users, creating a win-win model

Effect: 80 million user base, 1.5 million X followers, and a highly active community

The relationship between CAC and LTV is not a simple linear one but a complex function determined by community engagement, product differentiation, and user conversion efficiency. The most successful projects find ways to reduce the “unit cost of community engagement,” achieving maximum engagement with minimal economic incentives through well-designed mechanisms.

III. Quantitative Differentiation Between “Pseudo-Communities” and “True Communities”

Community Activity ≠ Community Value

The industry generally evaluates project potential based on community size and social media activity, but this approach struggles to distinguish “pseudo-activity” from “real participation.”

Hyperliquid, a DEX founded less than two years ago, has garnered significant attention over the past year. It has pioneered a new era of DEX prominence with excellent trading efficiency and controlled risk. According to Hypurrscan, Hyperliquid’s annualized fee revenue has reached $746 million, compared to Coinbase’s projected $4 billion in annual trading revenue in 2024. Hyperliquid’s venture-capital-free model and post-token-distribution success are noteworthy, with the majority of tokens distributed to the community:

No allocation to VCs: Tokens were fully distributed to users rather than venture capital firms.

Stable market performance: The token price remained stable after distribution, with no sharp volatility.

Organic community growth: Growth relied entirely on genuine user participation rather than artificial incentives.

Contribution-based allocation: Tokens were allocated based on users’ activity and contributions, not just purchases.

Hyperliquid boasts 53,510 Discord members and 221.8K X followers. More importantly, its community members are also product users, not only discussing price trends but also actively providing product advice. This deep engagement delivers tangible value, driving Hyperliquid’s perpetual futures market share from under 2% in March 2023 to 60.5% in February 2024.

TagAI, a Launchpad on the BSC chain, centers on a no-presale, equal-opportunity participation model, fostering an ecosystem where the community and projects grow together. TagAI ensures fairness, transparency, and accessibility, allowing all users to participate in launches and investments on the same conditions. Beyond its launchpad feature, TagAI is exploring a novel social distribution model powered by AI to make interactions more valuable. Specifically, each holder can be a community member; a member (A) can ask questions to others (B), and after B answers, all holders in the community can reward recognized answers with points. Simultaneously, AI captures B’s answer, reward it upon recognition and convert high-quality content into “learning material” to continuously optimize and deliver more valuable insights back to the community.

Currently, community members can earn token rewards by posting tweets on X with hashtags like #tagai (or @TagAIDAO) and #TTAI, which will be automatically shared with the TagAI community. This creates a win-win-win scenario for the community, project, and individuals, building a value-interconnected ecosystem based on social content. Despite only 3,762 X followers and 866 Telegram members, TagAI’s community drives efficient participation through content creation with specific tags, demonstrating that community value lies in participation quality and conversion efficiency, not scale.

Identification Metrics and Quantitative Methods for High-Participation Communities

Based on the analysis of multiple projects, we propose the following key metrics and their specific quantitative methods for identifying “true communities”:

Interaction-to-Action Conversion Rate (ITR):

Definition: The proportion of community discussions that converted into actual actions.

Calculation: ITR = Number of Actual Actions ÷ Total Community Discussions × 100%.

Metrics: Staking participation rate, governance voting rate, product usage conversion rate.

Benchmark: A healthy community typically has an ITR >15%; a high-quality community has an ITR >30%.

2. Social Fission Factor (SVF):

Definition: The number of new users brought in by a single active user within a specific time period.

Calculation: SVF = Number of New Users ÷ Number of Existing Active Users.

Application: Measures user referral efficiency and community expansion rate.

Benchmark: An SVF >0.2 is considered good; an SVF >0.5 is considered excellent.

3. User-Generated Content Ratio (UGCR):

Definition: The proportion of content spontaneously created by community members without direct incentives.

Calculation: UCGR = Number of Non-Incentivized Content ÷ Total Content × 100%.

Evaluation: Proportion of original content, secondary creation activity, cross-platform dissemination.

Benchmark: A UCGR >25% indicates a community with spontaneous vitality.

4. Crisis Response Resilience Index (CRI):

Definition: The ratio of community activity during market downturns and booms.

Calculation: CRI = Community Activity Metrics in Bear Market ÷ Community Activity Metrics in Bull Market.

Example: Shoggoth maintained content creation and sharing despite its market cap dropping from $200M to $5M.

Benchmark: A CRI >0.6 indicates a community with high resilience.

Comparative Analysis of Project Community Metrics

From the table above, it is evident that pure community size does not have a linear relationship with actual community value. Shoggoth has extremely high crisis response resilience despite its relatively small community size, while Hyperliquid demonstrates the value of a high interaction-to-action conversion rate by converting community members into product users and realizing significant market share growth.

IV. Lifecycle and Critical Point Analysis of Communities

For projects in the CommunityFi section, the biggest challenge is the token price decline triggered by insufficient liquidity, which leads to the loss of confidence in the community and the departure of community members. This situation is common in the current market, and it’s very important for the community to maintain the original intent of the project during price downturns. Bear markets typically bring low market sentiment, waning investor confidence, and liquidity shortages, which can be a huge strain on any project that relies on market participation and capital inflows.

Competition between communities is another potentially significant challenge. For instance, projects on BSC like Broccoli compete for the limited meme coin or token resources, potentially leading to vicious internal or external community rivalry. Resource contention, mutual attacks and defamation can undermine a project’s core value and narrative, as well as decrease its credibility. Such vicious competition is not only harmful to the community but may also cause user dissatisfaction and further affect the stability and growth of the project. Therefore, maintaining community unity and long-term development amidst fierce competition is a critical concern.

Three-Stage Model of Community Development

By observing projects like PEPE, Azuki, and Broccoli, we identify three key stages of community development:

Explosion Phase: Characterized by rapid user growth and high social media exposure. For example, PEPE’s market cap surpassed $1 billion within a few weeks of launch, with memes widely spread.

Maturity Phase: User growth slows down, but engagement depth increases. Azuki deepens community engagement through offline events e.g., NFT NYC Azuki Garden Party, Las Vegas Follow The Rabbit.

Transformation or Decline Phase: New elements need to be introduced to maintain vitality. For example, Azuki introduced a virtual city “Hilumia,” an anime platform “Anime.com” with the ANIME token to extend its lifecycle.

Community development is not linear but marked by multiple tipping points, particularly the transition from explosive growth to maturity, which might determine a project’s long-term viability.

Nonlinear Relationship Between Token Price and Community Vitality

It’s conventionally assumed that token price directly reflects community consensus strength, but data reveals a more nuanced relationship.

In the case of Shoggoth, despite its market cap dropping from $200M to $5M, community activity did not decline by the same proportion. Instead, many members keep content creation and interaction, demonstrating resilience beyond price fluctuations.

The Broccoli case further illustrates this. Multiple tokens named Broccoli coexist on BSC, and the top 3 by market cap ($40.8M, $17.2M, and $8.5M) each has distinct holder bases (39,761, 14,072, and 13,952). These communities, while centered on the same concept (CZ’s pet dog Broccoli), formed their own independent ecosystems. Compared to token price, community identity and narrative strength might determine community vitality more.

V. Methodology Construction

Dual-Factor Community Analysis Model: Quantitative Metrics and Case Validation

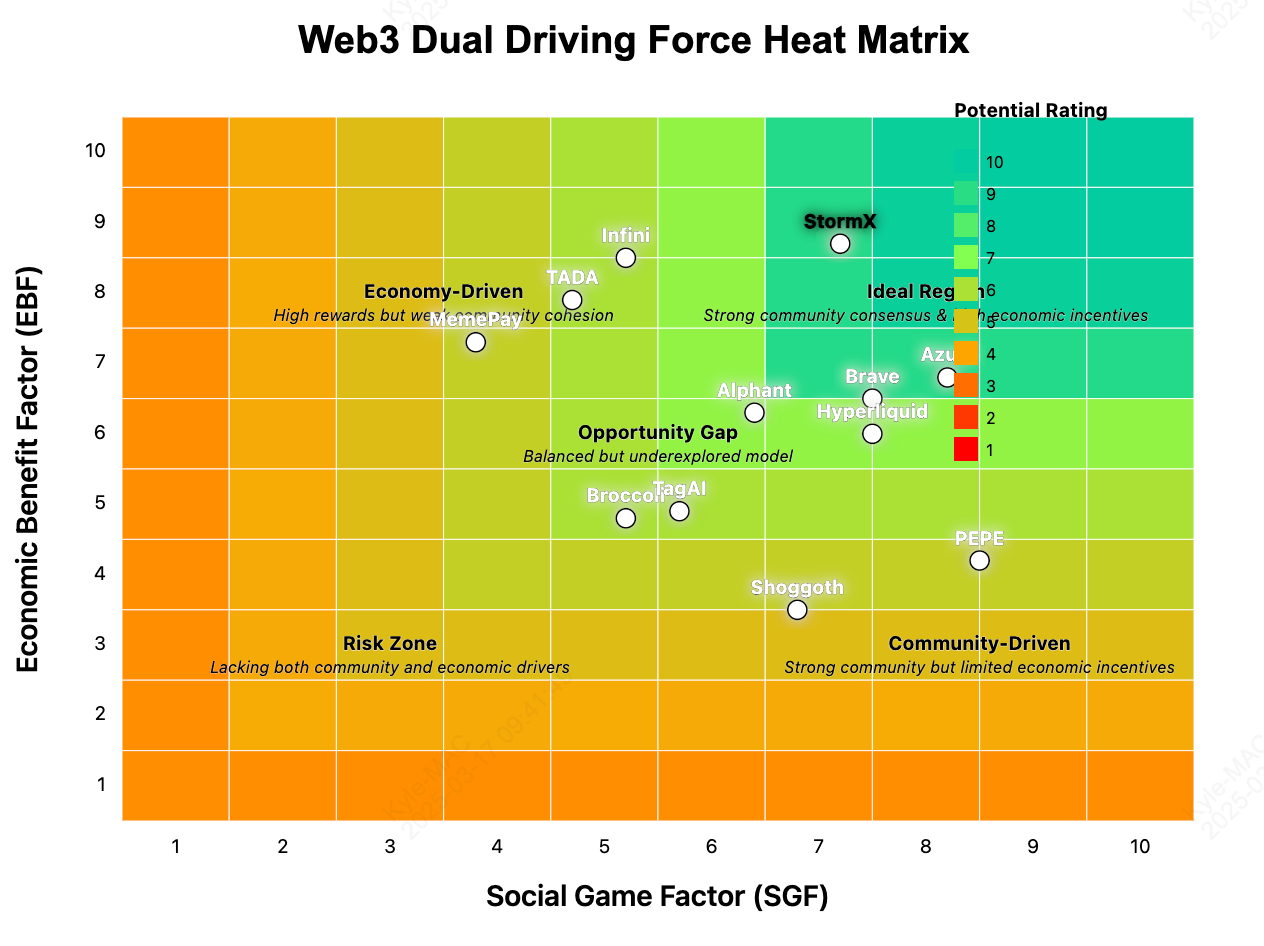

Before exploring the dual-factor community analysis model, the core concepts are defined:

Dual-Factor Community Analysis Model: A framework for evaluating the quality and potential of a Web3 community, which comprehensively evaluates the structure of user drivers through the analysis of the two dimensions: Social Gaming Factor (SGF) and Economic Benefit Factor (EBF).

Based on this definition, we specify the two factors:

Social Gaming Factor (SGF): Measures the non-economic value that users gain through participation, including identity, social influence, and social capital. It focuses on the psychosocial driver of why users participate.

Economic Benefit Factor (EBF): Measures the economic returns that users gain through participation, including immediate rewards, long-term benefits, and value-acquisition efficiency. It focuses on the economic driver of what users can get.

Through quantitative metrics and case comparisons, an operational framework is provided to evaluate Web3 projects’s potential:

Social Gaming Factor (SGF) Measures the benefits users expect from social interaction, which can be quantified via specific metrics:

SGF Composite Score should be calculated as: SGF = (Identity Value × 0.4) + (Influence Leverage × 0.3) + (Social Capital × 0.3)

SGF Score Comparison:

PEPE: High (8.5/10) — Strong identity and meme culture

Azuki: High (8.2/10) — Strong brand identity and offline engagement

Hyperliquid: Medium-High (7.5/10) — Mass adoption and professional community

Shoggoth: Medium (6.8/10) — Strong identity in specific space with limited scale

Broccoli: Low-Medium (5.2/10) — Separate community with weak identity

Economic Benefit Factor (EBF) Measures economic returns, which can be assessed via quantitative metrics:

EBF Composite Score should be calculated as: EBF = (Instant Rewards × 0.35) + (Long-Term Benefits × 0.35) + (Value Capture Efficiency × 0.3)

EBF Score Comparison:

StormX: High (8.7/10) — High cashback and tiered incentives

Infini: High (8.5/10) — Stable high yields and low-friction usage

TADA: Medium-High (7.9/10) — High initial subsidy with limited sustainability

Brave: Medium (6.5/10) — Stable and moderate incentives

Alphant: Medium (6.3/10) — Gamified rewards with complex acquisition

Dual-Factor Equilibrium and Project Positioning Matrix. There is a dynamic equilibrium between these two factors, visualized through the SGF-EBF matrix: [SGF-EBF Matrix]

In the case of Alphant, it integrates Game-Fi and Social-Fi voice chat rooms, where users earn $TALK tokens by chatting or completing tasks and win rewards through PVP or PVE battles. This design activates both SGF (community interaction) and EBF (token rewards), achieving a balance of medium-high SGF and medium EBF, which positions it as promising but needs to strengthen its long-term economic incentives. Projects should target their matrix position to strengthen weaker factors, e.g., high SGF & low EBF projects can introduce sustainable economic incentives, while low SGF & high EBF projects should enhance community identity and participation.

Framework for Analyzing Differences Between Users’ True Preferences and Explicit Behaviors

Users’ public expressions usually diverge significantly from their actual behaviors. In the case of Brave, users ostensibly emphasize privacy, but data indicates that many users are equally attracted by BAT rewards.

Brave’s 80 million+ users ostensibly choose it for privacy, but actually, Brave Rewards (earning BAT by viewing ads) provides an additional economic incentive, a dual driver key to retention.

This difference is even more pronounced in ConsumerFi projects. MemePay allows users to make daily payments with memecoins (e.g., $MEME, $SHIB, $PEPE) to earn scratch card rewards, high cashback, and airdrop. Ostensibly, users adopt MemePay for convenient payments, but many are actually attracted by high rewards and gamified experiences.

Successful Web3 projects satisfy both explicit needs (e.g., easy payments, privacy protection) and latent desires (e.g., economic rewards, community belonging).

VI. Unified Web3 Community Project Evaluation Framework: Integrating CommunityFi and ConsumerFi

The True Drivers of User Formation

Through in-depth analysis of CommunityFi and ConsumerFi projects, we derive a key insight: Web3 users are not pre-existing but are dynamically shaped within specific community environments and consumption scenarios.

User formation is influenced by multiple factors:

Interest Drivers: Direct economic returns (token rewards, cashback) and indirect benefits (social capital, future growth expectations).

Social Game: Complex networks of interaction, competition, and cooperation among users.

Contextual Design: Specific environments and scenarios, such as MemePay’s “pay — earn — repeat” loop.

This implies that successful Web3 projects must focus beyond product features and tokenomics and further design “user formation mechanisms” to transform potential users into active community members. Based on the previous analysis, we propose a unified and universal framework for evaluation and optimization of CommunityFi and ConsumerFi projects:

“Dual-Wheel Drive” Evaluation Model

Core Definition: The “Dual-Wheel Drive” model is a universal framework that integrates community strength and user experience to evaluate projects’ long-term potential across four dimensions and 16 key metrics. It is suitable for all types of Web3 projects, from purely community-driven CommunityFi to consumption-focused ConsumerFi projects, and solves the limitations of traditional evaluations that treat these types separately.

Four Dimensions and Key Metrics

This translation preserves the structure and content of the original table while converting all text into English. Let me know if you need further adjustments!

Dynamic Weighting Mechanism

A key innovation is the dynamic weighting mechanism, which makes the evaluation flexible to the project characteristics:

Final Score = (User Acquisition Efficiency × 25%) + (Value Retention Structure × 25%) + (Community Engagement Depth × (15%35%)) + (User Experience Closed Loop × (15%35%))

CommunityFi Projects: Community Engagement Depth weight increases to 35%, User Experience Closed Loop decreases to 15%.

ConsumerFi Projects: User Experience Closed Loop weight increases to 35%, Community Engagement Depth decreases to 15%.

Hybrid Projects: Weights are moderately adjusted based on project characteristics.

Project Type Identification and Evaluation Adjustment

To ensure accuracy, we provide the criteria to identify project types:

CommunityFi Characteristics:

Community decisions impact project development by >25%.

User-generated content accounts for >20% of total content.

User identity is highly correlated with participation.

Community member interactions exceed user-product interactions.

ConsumerFi Characteristics:

Clear consumption scenarios and user pain point solutions.

User experience directly affects retention.

Economic incentives are highly correlated with usage.

Product utility overrides community engagement.

Hybrid Characteristics:

Combines community-driven and consumption scenarios.

Users are both consumers and community participants.

Consumptions and engagements have clear interaction mechanisms.

Examples: Brave, StormX, Alphant, etc.

Scoring Standards and Action Guidelines

Based on this framework, we provide scoring standards and action guidelines for different project tiers:

Practical Application Cases and Optimization Paths

To enhance the framework’s practicality, we evaluate sample projects and offer optimization suggestions:

Brave Browser (Hybrid Project):

User Acquisition Efficiency: 82/100 (Low CAC, multi-channel acquisition)

Value Retention Structure: 78/100 (High retention, stable LTV)

Community Engagement Depth: 70/100 (Moderate engagement, limited governance)

User Experience Closed Loop: 85/100 (Excellent browsing, seamless BAT integration)

Total Score: 78.75/100 (A-tier)

Optimization: Enhance community decision-making mechanisms and governance transparency.

PEPE (Pure CommunityFi Project):

User Acquisition Efficiency: 75/100 (Community-driven low-cost acquisition)

Value Retention Structure: 60/100 (High volatility but strong community stickiness)

Community Engagement Depth: 88/100 (Highly active meme creation and sharing)

User Experience Closed Loop: 45/100 (Limited functionality, value in community)

Weighted Score: 72.50/100 (A-tier, 35% community weight, 15% UX weight)

Optimization: Develop practical features to enhance user experience.

TADA Taxi (ConsumerFi-Leaning Project):

User Acquisition Efficiency: 65/100 (High CAC but precise targeting)

Value Retention Structure: 75/100 (High driver retention, sustained user value)

Community Engagement Depth: 60/100 (Limited community engagement)

User Experience Closed Loop: 82/100 (Convenient ride payment experience)

Weighted Score: 71.75/100 (A-tier, 35% UX weight, 15% community weight)

Optimization: Reduce CAC, enhance community engagement.

This unified framework resolves the traditional disconnect in evaluating CommunityFi and ConsumerFi projects, offering a fair, comprehensive standard through dynamic weight adjustments to guide investors and project teams in decision-making.

Conclusion

This study reexamines CommunityFi and ConsumerFi projects through data and case studies, challenging conventional perceptions of Web3 users. We find that successful Web3 projects do not merely serve predefined user groups but actively shape user behavior and preferences through carefully designed community mechanisms and consumption scenarios.

In the next phase of Web3 development, true competitive advantage lies not in technological innovation or marketing tactics, but in who can better understand and shape users, not by unilaterally changing them, but by creating an ecosystem where users can grow and benefit together.

About Bing Ventures

Bing Ventures is a pioneering venture capital and research firm affiliated with crypto exchange BingX. Founded in 2021, it aims to support transformative blockchain and crypto ventures and outstanding fund managers driving the next wave of innovations.

With a sector-agnostic, value-investing approach, it has a portfolio of more than 50 companies spanning infrastructure, DeFi, GameFi, Web3, and more, including, among others, Avail, Berachain, Manta Network, Pixelmon, Unisat, and Solv Protocol.

Bing Ventures is also a Limited Partner (LP) of several leading crypto funds, including those managed by Hack VC, Bankless Ventures, Maven 11 Capital, IOSG Ventures, and Figment Capital.

For more information, please visit: Website | LinkedIn | Twitter